Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

Verizon Communications Inc. (NYSE:VZ)

- Dividend Yield: 6.04%

- B of A Securities analyst David Barden maintained a Neutral rating and raised the price target from $41 to $45 on Sept. 26. This analyst has an accuracy rate of 65%.

- Citigroup analyst Michael Rollins maintained a Buy rating and increased the price target from $47 to $49 on Sept. 25. This analyst has an accuracy rate of 77%

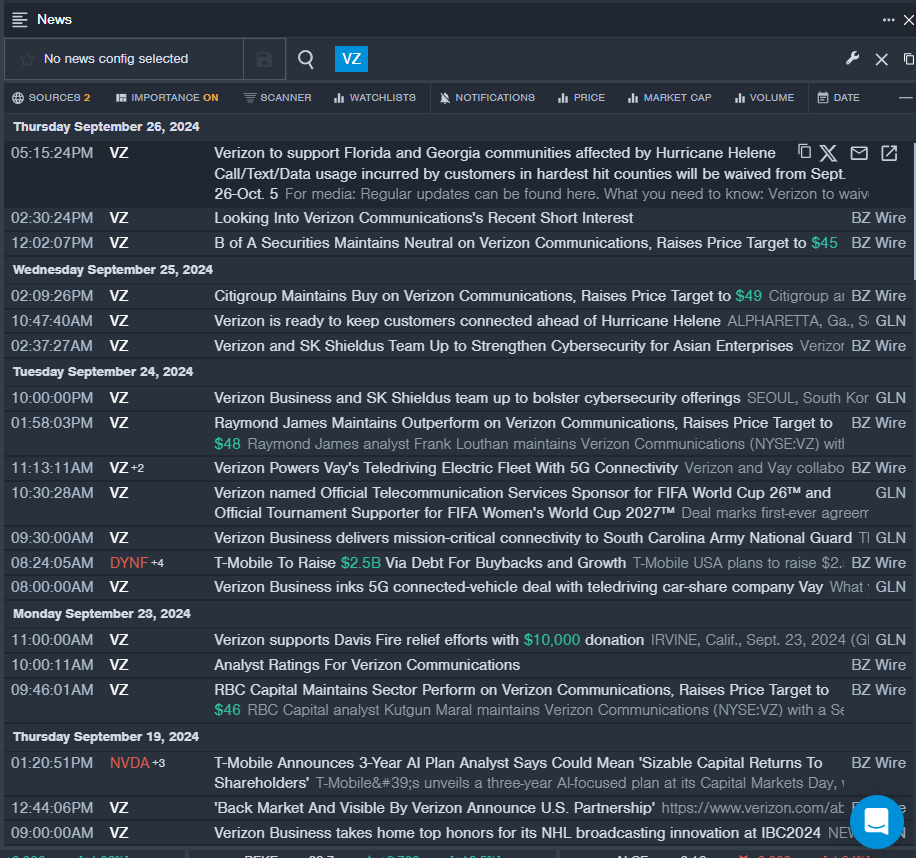

- Recent News: Vay collaborated with Verizon Communications to integrate Verizon 5G connectivity into Vay's fleet of teleoperated electric vehicles.

- Benzinga Pro's real-time newsfeed alerted to latest VZ news.

AT&T Inc. (NYSE:T)

- Dividend Yield: 5.07%

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $29 to $30 on Sept. 27. This analyst has an accuracy rate of 73%.

- Citigroup analyst Michael Rollins maintained a Buy rating and increased the price target from $21 to $24 on Sept. 11. This analyst has an accuracy rate of 77%

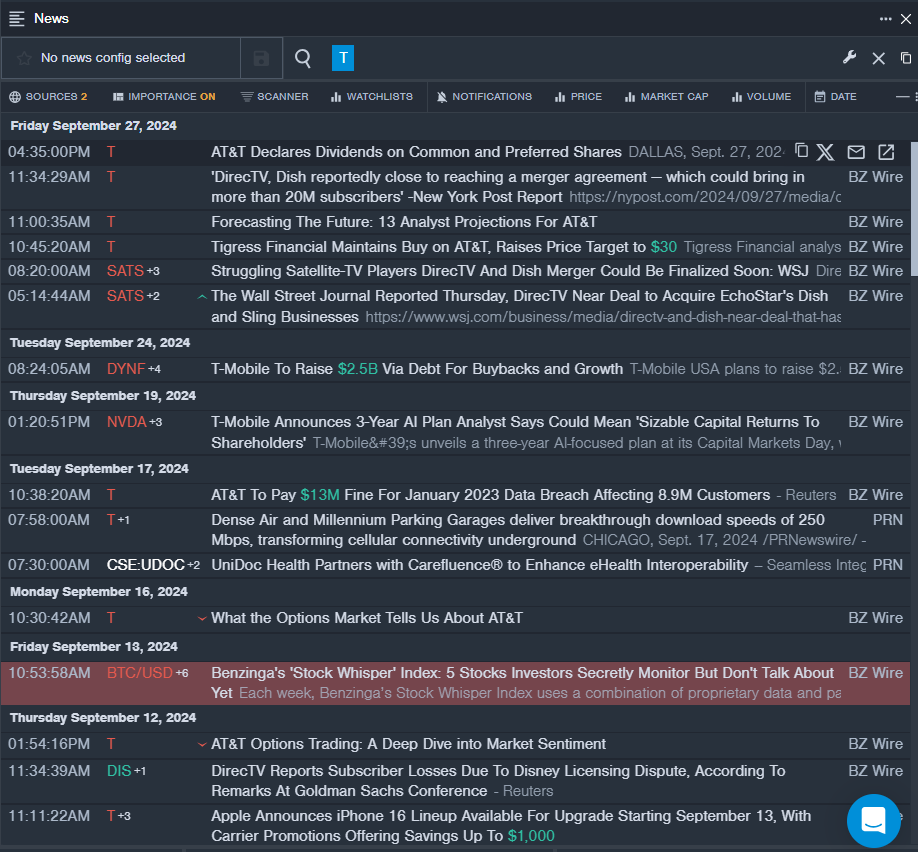

- Recent News: The company's board of directors declared a quarterly dividend of $27.75 cents per share on common shares.

- Benzinga Pro's real-time newsfeed alerted to latest T news.

The Interpublic Group of Companies, Inc. (NYSE:IPG)

- Dividend Yield: 4.17%

- Barclays analyst Julien Roch maintained an Equal-Weight rating and cut the price target from $35 to $34 on July 25. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst Benjamin Swinburne downgraded the stock from Equal-Weight to Underweight and cut the price target from $34 to $28 on July 22. This analyst has an accuracy rate of 76%.

- Recent News: On Sept. 18, Interpublic named Alex Hesz as Chief Strategy Officer.

- Benzinga Pro’s charting tool helped identify the trend in IPG stock.

Read More:

Latest Ratings for VZ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | JP Morgan | Downgrades | Overweight | Neutral |

| Jan 2022 | Tigress Financial | Maintains | Buy | |

| Dec 2021 | Daiwa Capital | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: communication servicesNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas