Federal Reserve Rates 'Justified' Despite Being Highest Among G-10 Peers, Says LPL Economist As Trump Pressures Jerome Powell To Exit

Despite holding the highest policy rate among G-10 nations, Jeffrey Roach, the Chief Economist at LPL Financial, emphasizes that while the administration’s lobbying for lower rates is not new, the Federal Reserve‘s independence in pursuing its mandate remains paramount.

What Happened: According to Roach, the U.S. Fed has no immediate reason for aggressive rate cuts, even though its G-10 peers have lower rates.

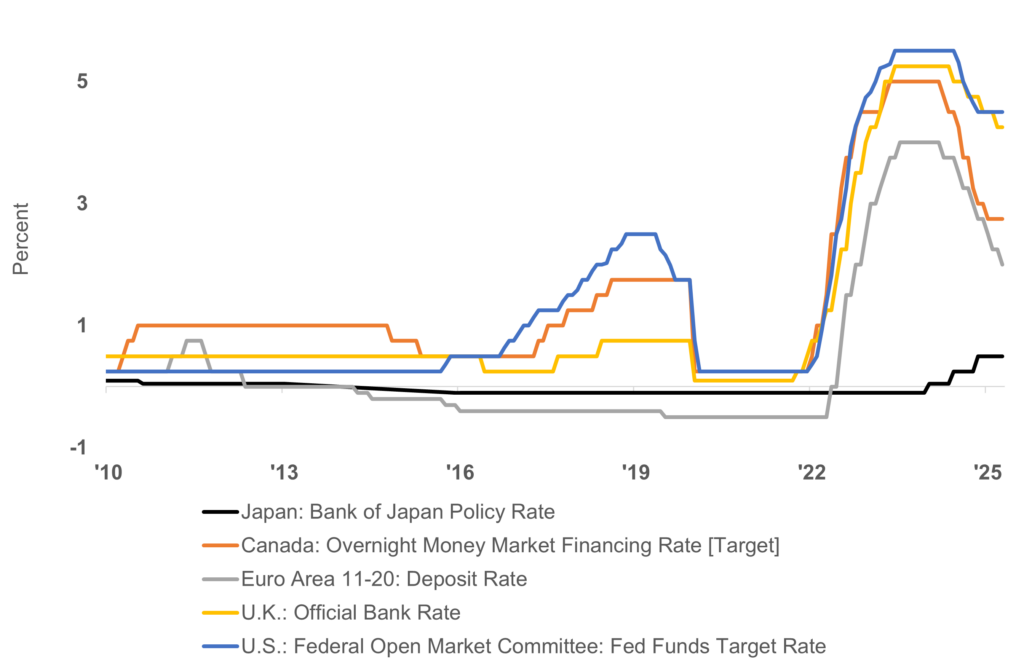

As illustrated by the graphic shared by LPL Financial with Benzinga, the U.S. Federal Open Market Committee’s Target Rate stands noticeably above those of Japan, Canada, the Euro Area, and the U.K., extending to mid-2025.

Roach acknowledges this disparity but posits that “The exceptional nature of our economy, the depth of our capital markets, and the safety of our legal structure often warrant a policy rate above international rates.”

Crucially, Roach defines “Fed Independence” as “the ability to pursue their congressional mandate (full employment and stable prices) without outsider influence.”

He highlights that while good central banking considers an “integrated international economy,” it must remain “independent of political pressure if able to perform duties without fear of getting fired without cause.”

The LPL economist asserts that current economic conditions do not support dramatic monetary easing. “There is no reason to aggressively cut rates down to one or two percent when inflation is above the Fed's target, unemployment is low, and the economy is still growing,” Roach stated.

He suggests the Fed might “shave off a few quarter points by the end of the year if inflation stabilizes,” but a significant downward move is not justified by the data.

Why It Matters: Amid the ongoing backdrop of President Donald Trump urging Fed Chair Jerome Powell to slash interest rates, economists Mohamed El Erian and Jeremy Siegel have urged Powell to resign gracefully.

El Erian noted that safeguarding the Fed's operational autonomy is crucial and suggested that this objective could be achieved if Powell steps down.

"If Chair Powell's objective is to safeguard the Fed's operational autonomy (which I deem vital), then he should resign," wrote El-Erian.

On the other hand, Siegel said, “Some will argue that resignation under political pressure would undermine the central bank’s autonomy. I believe the opposite. A graceful, voluntary exit now could shield the institution from greater political intervention later.”

“If the economy weakens, it will be Trump’s Fed Chair in place—there’s no one else to blame. If the economy holds steady or improves, little would change in terms of perception, and the Fed’s independence would remain intact,” he added.

Price Action: The CME Group's FedWatch tool‘s projections show markets pricing a 95.3% likelihood of the Federal Reserve keeping the current interest rates unchanged in its July meeting.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.40% at $631.39, while the QQQ advanced 0.22% to $562.50, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Federal Reserve