These Analysts Raise Their Forecasts On Verizon After Upbeat Q2 Results

Verizon Communications Inc. (NYSE:VZ) reported better-than-expected second-quarter financial results and raised guidance on Monday.

Verizon posted adjusted earnings of $1.22 per share, beating market estimates of $1.19 per share. The company’s quarterly sales came in at $34.50 billion beating expectations of $33.57 billion.

Total Verizon Business revenues were $7.3 billion, down 0.3% Y/Y. Total Verizon Consumer revenue rose by 6.9% Y/Y to $26.6 billion. Consumer wireless retail postpaid churn was 1.12%, and wireless retail postpaid phone churn was 0.90%.

For FY25, Verizon reiterated a 2.0%-2.8% growth in wireless service revenue. It narrowed its adjusted EPS outlook from $4.59-$4.73 to $4.64-$4.73 versus the consensus of $4.68, driven by demand for its higher-tier plans as per the Reuters report.

Verizon shares gained 4% to close at $42.49 on Monday.

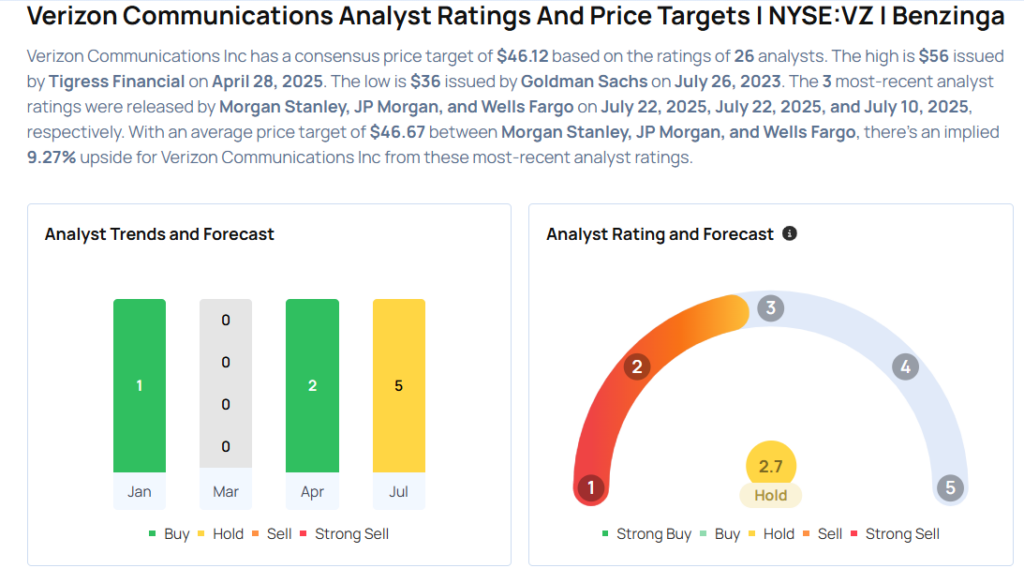

These analysts made changes to their price targets on Verizon following earnings announcement.

- JP Morgan analyst Philip Cusick maintained Verizon with a Neutral and raised the price target from $47 to $49.

- Morgan Stanley analyst Benjamin Swinburne maintained the stock with an Equal-Weight rating and raised the price target from $47 to $48.

Considering buying VZ stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for VZ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | JP Morgan | Downgrades | Overweight | Neutral |

| Jan 2022 | Tigress Financial | Maintains | Buy | |

| Dec 2021 | Daiwa Capital | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas