NYCB Shares Keep Falling As Investors Weigh 'Significant And Very Expensive' Financial Strategy

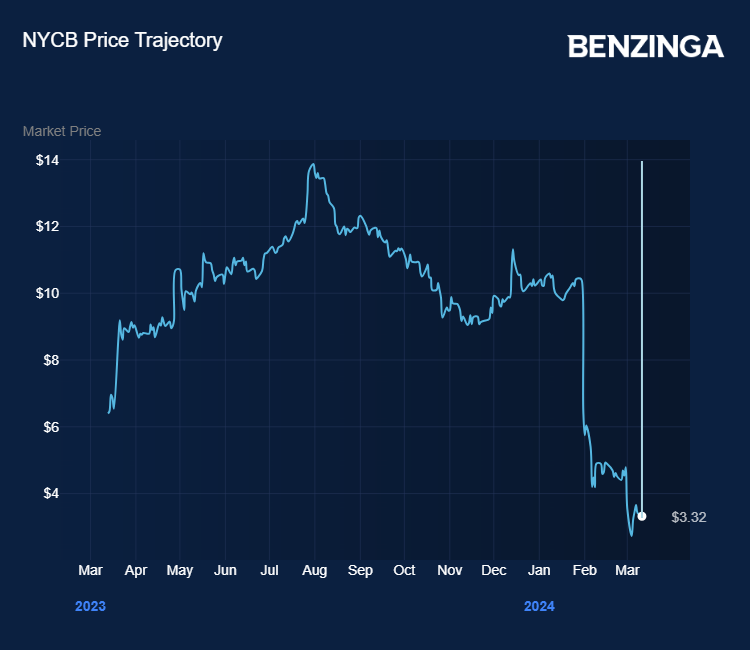

Shares in New York Community Bancorp (NYSE:NYCB) continued to fall heavily on Monday after a brief pick-up last week following the announcement of a $1 billion capital raise.

On Wednesday last week, it was announced that Steven Mnuchin, former Treasury Secretary, along with a number of other outside investors, would invest $1 billion in NYCB, sending shares up by 7.5% on the day.

The announcement’s stimulative impact didn’t last long, once investors realized the price they would be paying for the $1 billion injection. New shares were issued at $2, a deal that was described as “meaningfully dilutive to common shares” by analysts at Wedbush.

Wedbush rated the stock Underperform “based on NYCB’s above average exposure to commercial real estate (CRE) loans.” It set a target price of $3.

Significant And Expensive

Christopher McGratty at Keefe, Bruyette and Woods, said: “Last week’s capital raise was significant and very expensive, but also necessary to strengthen the balance sheet and begin to restore investor confidence.”

Retaining its Market Perform rating on the stock, KBW recalculated its earnings expectations on NYCB and readjusted its return on equity and price to tangible book value estimations to come up with a new target price of $3.75, reduced from its previous $7.50.

The analyst added that of the likely options for NYCB, a loan sale or credit risk transfer would likely follow.

“A loan sale would be the cleanest transaction, and here we believe the $13 billion of commercial and industrial loans acquired from Signature Bank could be a good option given the shorter duration and recently marked nature of the book,” said McGratty.

On Monday, the shares were down 4.4% at $3.26 at the time of publication Monday.

Fed Concerns Over CRE Exposure

Smaller banks’ exposure to CRE has become of increasing concern — not just to the banks and their depositors and investors —but also to banking regulators and other government agencies, including the Federal Reserve.

Last week, in front the Senate Banking Committee, Fed Chair Jerome Powell said: “There will be more failures.” But, he noted that the Fed had seen the problem coming and had been working with regional banks.

He added that this was a small and medium-sized bank problem — not a major concern for the large institutions.

Indeed, KBW analysts noted that banks with more than $100 billion in assets under management, held a combined 10% of outstanding CRE loans, while banks with less than $10 billion held over 40% of CRE loans.

The SPDR S&P Regional Banking ETF (NYSE:KRE), an exchange traded fund that tracks the regional banks listed on the S&P 500, was down 0.5% on Monday.

Among its top holdings, Citizens Financial Group Inc. (NYSE:CFG) was down 1.2%, while Regions Financial Corporation (NYSE:RF) was down 0.9% and Truist Financial Corp. (NYSE:TFC) shed 1%.

Now Read: Mnuchin Wants To Turn New York Community Bancorp Into ‘Very Attractive’ Regional Bank

Photo: Below the Sky/Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities Mid Cap News Sector ETFs Downgrades Financing Price Target Reiteration