Beyond The Numbers: 4 Analysts Discuss Citizens Financial Group Stock

During the last three months, 4 analysts shared their evaluations of Citizens Financial Group (NYSE:CFG), revealing diverse outlooks from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

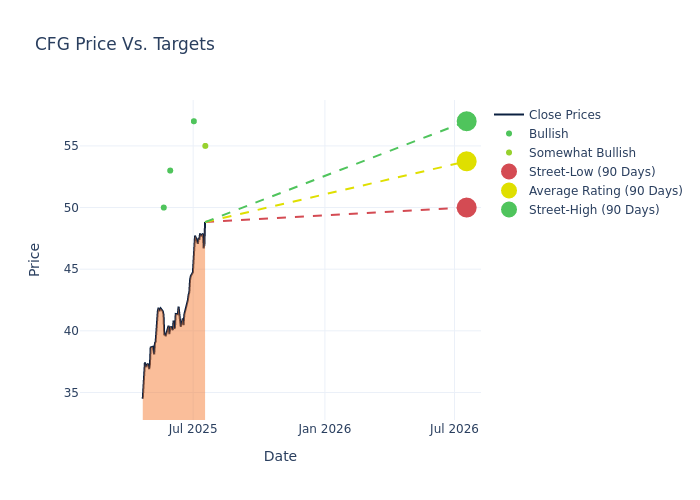

The 12-month price targets, analyzed by analysts, offer insights with an average target of $53.75, a high estimate of $57.00, and a low estimate of $50.00. Witnessing a positive shift, the current average has risen by 8.21% from the previous average price target of $49.67.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive Citizens Financial Group is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Pancari | Evercore ISI Group | Raises | Outperform | $55.00 | $48.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $57.00 | $51.00 |

| Erika Najarian | UBS | Raises | Buy | $53.00 | $50.00 |

| David Chiaverini | Jefferies | Announces | Buy | $50.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Citizens Financial Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Citizens Financial Group compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Citizens Financial Group's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Citizens Financial Group's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Citizens Financial Group analyst ratings.

About Citizens Financial Group

Citizens Financial Group Inc is a bank holding company headquartered in Providence, Rhode Island. Through the bank, it offers various retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions. The company's reportable segments are; Commercial Banking, Consumer Banking, Non-Core, and Others. A majority of its revenue is generated from the Consumer Banking segment, which serves consumer customers and small businesses, offering traditional banking products and services including deposits, mortgage and home equity lending, credit cards, small business loans, education loans, point-of-sale finance loans, and wealth management and investment services.

Unraveling the Financial Story of Citizens Financial Group

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Challenges: Citizens Financial Group's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -1.23%. This indicates a decrease in top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 17.57%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.51%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Citizens Financial Group's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.16%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.54, caution is advised due to increased financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CFG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Credit Suisse | Maintains | Neutral | |

| Jan 2022 | UBS | Initiates Coverage On | Neutral | |

| Jan 2022 | Citigroup | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings