Demystifying Allison Transmission: Insights From 5 Analyst Reviews

Ratings for Allison Transmission (NYSE:ALSN) were provided by 5 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 2 | 1 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 1 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

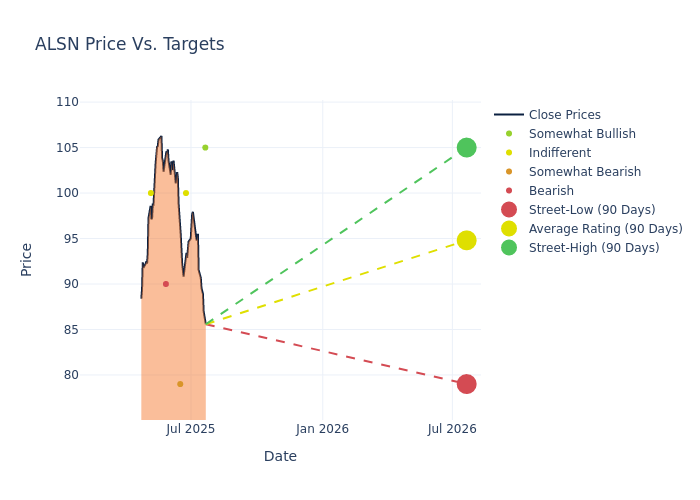

The 12-month price targets, analyzed by analysts, offer insights with an average target of $94.8, a high estimate of $105.00, and a low estimate of $79.00. Marking an increase of 2.38%, the current average surpasses the previous average price target of $92.60.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Allison Transmission. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tim Thein | Raymond James | Lowers | Outperform | $105.00 | $110.00 |

| Kyle Menges | Citigroup | Lowers | Neutral | $100.00 | $105.00 |

| Sherif El-Sabbahy | B of A Securities | Raises | Underperform | $79.00 | $74.00 |

| Jerry Revich | Goldman Sachs | Raises | Sell | $90.00 | $80.00 |

| Angel Castillo | Morgan Stanley | Raises | Equal-Weight | $100.00 | $94.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Allison Transmission. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Allison Transmission compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Allison Transmission's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Allison Transmission's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Allison Transmission analyst ratings.

Discovering Allison Transmission: A Closer Look

Allison Transmission is the largest manufacturer of fully automatic transmissions for commercial vehicles. The company's automatic transmissions allow customers to achieve better fuel and operator efficiency than less expensive manual and automated manual transmissions. Allison serves several end markets, including on- and off-highway equipment and military vehicles. Its on-highway business has about 60% global market share. The company's transmissions can be found in Class 4-8 trucks, buses, and a limited number of large passenger vehicles (heavy-duty pickup trucks and motor homes). Allison also produces electric hybrid propulsion systems and is developing e-powertrains.

Key Indicators: Allison Transmission's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Allison Transmission faced challenges, resulting in a decline of approximately -2.92% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Allison Transmission's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 25.07%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Allison Transmission's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 11.58%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Allison Transmission's ROA stands out, surpassing industry averages. With an impressive ROA of 3.59%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Allison Transmission's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.44, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ALSN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Credit Suisse | Downgrades | Outperform | Neutral |

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Dec 2021 | Morgan Stanley | Downgrades | Equal-Weight | Underweight |

Posted-In: BZI-AARAnalyst Ratings