Top 2 Health Care Stocks You May Want To Dump This Quarter

As of July 22, 2025, two stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Medpace Holdings Inc (NASDAQ:MEDP)

- On July 21, Medpace Holdings reported better-than-expected second-quarter financial results and raised its FY25 guidance above estimates. Medpace expects 2025 revenue to be in the range of $2.42 billion to $2.52 billion, up from prior guidance of $2.14 billion to $2.24 billion. The company also raised its full-year earnings guidance from a range of $12.26 to $13.04 per share versus estimates of $13.76 to $14.53 per share. Analysts are forecasting 2025 revenue of $2.18 billion and earnings of $12.69 per share. The company's stock jumped around 192% over the past five years and has a 52-week high of $440.38.

- RSI Value: 83.2

- MEDP Price Action: Shares of Medpace fell 1% to close at $308.88 on Monday.

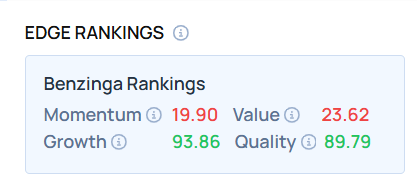

- Edge Stock Ratings: 19.90 Momentum score with Value at 23.62.

Recursion Pharmaceuticals Inc (NASDAQ:RXRX)

- On July 8, Recursion Pharmaceuticals announced it acquired the joint ENPP1 inhibitor program and associated backup molecule from Rallybio. “We extend our sincere thanks to Rallybio for their invaluable partnership in advancing this program to its current stage,” said David Hallett, Chief Scientific Officer of Recursion. The company's stock gained around 33% over the past month has a 52-week high of $12.36.

- RSI Value: 75.6

- RXRX Price Action: Shares of Recursion Pharmaceuticals gained 9.6% to close at $6.40 on Monday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas health care Overbought stocksNews Short Ideas Pre-Market Outlook Markets Trading Ideas