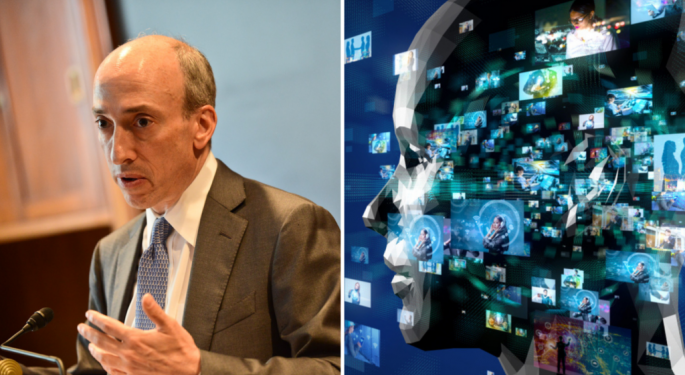

Gary Gensler Warns Companies About Artificial Intelligence Boasting: Don't 'AI Wash'

Artificial intelligence is one of the biggest topics among the financial sector and publicly traded companies.

As companies explore use cases and ways they can grow with AI, the chairman of the SEC is warning them not to oversell their capabilities.

What Happened: SEC Chairman Gary Gensler was a busy man in 2023 and is wrestling with the potential approval of Bitcoin ETFs.

At a recent event, Gensler cautioned companies about overstating the impact artificial intelligence could have on their financials.

"One shouldn't greenwash, and one shouldn't AI wash — I don't know how else to say it," Gensler said at the event, as shared by Decrypt.

"If you're raising money from the public, if you're offering and selling securities, you come under the securities laws and give full, fair, and truthful disclosure, and investors can decide."

While there have been concerns previously about companies making exaggerated claims about their ESG (environmental, social, and governance) practices, Gensler said he’s worried that AI could be the next area that misleads investors.

"We are worried about faking the markets and fraud on this macro issue. I think it really needs a lot of discussion amongst not just financial regulators here but around the globe."

Gensler also cautioned about using generative AI that could defraud the public.

"Let me just say fraud is fraud, and if there's a human that's using a model that's defrauding the public; that human — depending on the facts — is likely going to hear from us. Artificial intelligence as we know it now still has humans in the loop."

Related Link: US Lawmakers Want To Slash Gary Gensler’s Salary From Over $300K To Just $1 — Here’s Why

Why It's Important: Use cases for artificial intelligence have risen in 2023 and so have share prices of companies associated with the growth of the sector.

Shares of NVIDIA Corp (NASDAQ:NVDA) are up over 200% year-to-date in 2023. The company passed the $1-trillion market capitalization level in May and has been one of the best-performing large-cap companies.

Technology giant Microsoft Corp (NASDAQ:MSFT) invested $10 billion in OpenAI, the parent company of ChatGPT, earlier this year.

C3.ai Inc (NYSE:AI), an enterprise AI company, has seen shares increase over 130% year-to-date.

Other companies that include AI in their stock symbol or have AI in their name experienced high volatility during the 2023 year, with some ending up on Benzinga's Stock Whisper Index, which highlights companies seeing increased interest from retail traders.

AI was named the Word of the Year by Collins Dictionary for 2023. While there may be plenty of good things about the growth of AI, Gensler has shared several examples of ways that AI could be used poorly by publicly traded companies and bring potential penalties from the SEC.

Read Next: 3 Things You May Not Know About Gary Gensler: What About His Mega NFL TV Deal?

Photo: Gensler, Third Way Think Tank via Flickr Creative Commons; Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: AI AI stocks artificial intelligence artificial intelligence stocks Gary Gensler SECNews Tech