Why Is Apollo Global Going On A 2016 Shopping Spree?

This week, Apollo Global Management LLC (NYSE: APO) announced yet another major 2016 buyout, acquiring Coinstar and Redbox operator Outerwall Inc (NASDAQ: OUTR) for $1.6 billion. Apollo announced plans to take the company private.

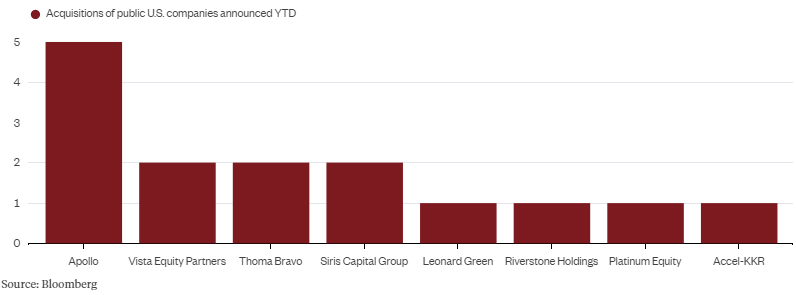

Outerwall is the fifth public company Apollo has bought in 2016, more than twice as many as any of its rivals. In addition to Outerwall, Apollo has acquired ADT Corp (previously traded (NYSE: ADT)), The Fresh Market Inc (previously traded (NASDAQ: TFM)), Apollo Education Group Inc (NASDAQ: APOL) and Diamond Resorts International Inc (NYSE: DRII).

With stocks near all-time highs, and a number of economists worried about the global economic outlook, why is Apollo being so aggressive? The combination of historically low borrowing costs and sluggish earnings growth is likely a key driver. However, at least in Outerwall’s case, Apollo also got a heck of a deal.

Even at an 11 percent premium to market price, Apollo’s bid for Outerwall was still way below the stock’s 52-week high of $82.87. In addition, the price represents only 4.3x Outerwall’s fiscal 2016 earnings.

Although Outerwall’s earnings suggest the business is in secular decline due to the rise of streaming video services, the company still generates plenty of cash flow and will likely continue to do so for years to come.

If Apollo sees additional opportunities in the public market, it has shown that it will not hesitate to pounce.

So far this year, Apollo’s stock is up 8.5 percent.

Full ratings data available on Benzinga Pro.

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!

Disclosure: the author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: ADT Corp Coinstar Redbox the fresh marketM&A News Best of Benzinga