APi Group's Rally Looks Strong, But Is It Sustainable?

Starting July 21, 2025, APi Group Corp (NYSE:APG) enters the 9th Phase of its 18-Phase Adhishthana Cycle on the weekly chart. At first glance, the structure appears healthy. But there’s one key concern around the timing of its recent breakout that raises questions about the sustainability of the rally—and why caution, or even hedging, may be essential.

APG's Cycle So Far

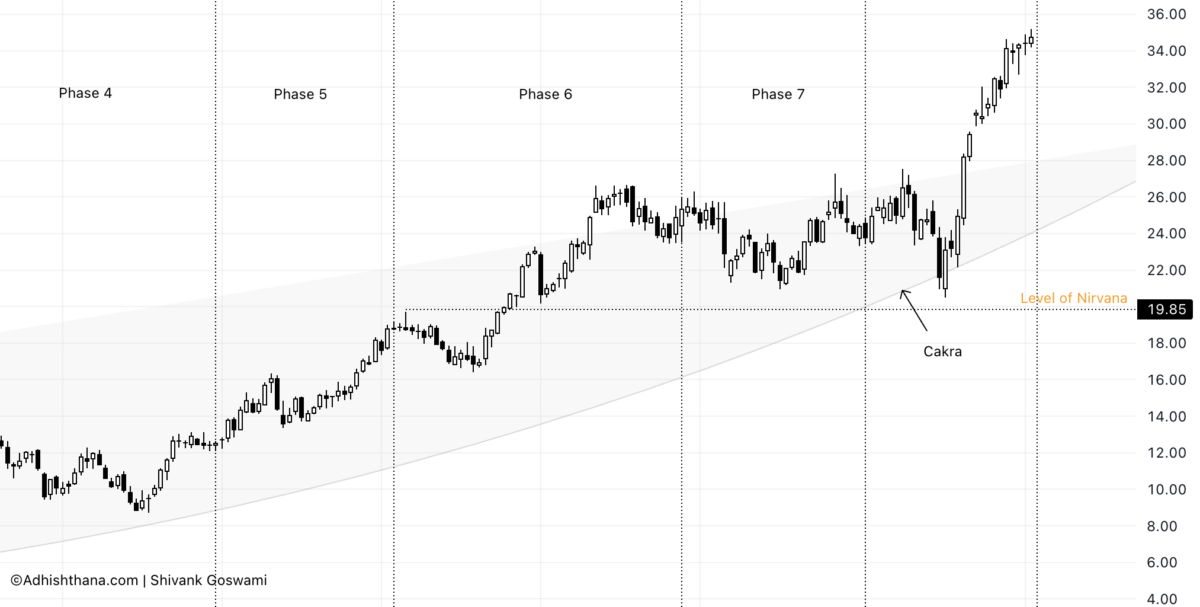

According to the Adhishthana Principles, stocks typically form a pattern called the Adhishthana Cakra between Phases 4 and 8—a structure that resembles a channel with an arc. Ideally, a breakout from this structure happens in Phase 9, setting the stage for the powerful Himalayan Formation that follows.

In APG's case, the Cakra formation did take shape between Phases 4 to 8. However, the breakout occurred toward the end of Phase 8—not in Phase 9, as ideally expected under the framework.

Quoting from my book Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"If the Cākra is broken to the upside before the completion of the cycle, the forces attract it to the Nirvana level as plotted in the 6th phase. This fall towards the Nirvana can often be brutal as a consequence of taking shortcuts to attain Nirvana."

While early breakouts closer to Phase 9 may occasionally pass without consequence, the monthly chart suggests this case may not be one of them.

APG Stock Monthly Chart: A Rally That Came Too Soon

On the monthly chart, APG is currently in Phase 2. This is traditionally a dual-phase: the early part, known as the Sankhya Move, tends to be consolidative or bearish, while the latter half, the Buddhi Move, is typically bullish towards its end.

Yet APG has already rallied nearly 200% from its Phase 2 lows—during the Sankhya Move itself. According to the principles, this kind of premature bullish move rarely sustains. History shows that the market often punishes such early euphoria.

Combined with the early breakout of the Cakra on the weekly chart, the timing of this move raises structural doubts. It suggests the rally may not be as stable as it looks on the surface.

Investor Outlook

Yes, the stock looks strong right now—and even JPMorgan recently upgraded it to Overweight with a bullish price target. But Adhishthana Principles suggest this may be a deceptive setup. Premature rallies often fizzle out, and when they reverse, the correction can be swift and steep.

With APG's illiquid options market, retail investors have limited room for hedging. That's why caution is warranted. Watch closely. Be ready to act.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas