Victoria's Secret Expects $50 Million Tariff Hit In 2025 — CFO Scott Sekella Says Q4 To Bear Largest Dollar Hit

On Wednesday, Victoria's Secret & Co. (NYSE:VSCO) CFO Scott Sekella explained how the company plans to manage the $50 million tariff impact across the second, third and fourth quarters.

What Happened: During the company's first-quarter earnings call, Sekella addressed the $50 million net tariff impact, stating that $10 million of this would be felt in the second quarter, while the remainder would be spread across the third and fourth quarters.

He said, "I think it’s going to be over Q3 and Q4 and fluctuate with the size of the volume in each of the quarters," adding, "There is more of an impact dollar-wise just because it’s a bigger quarter in Q4. But from a sort of rate or basis point impact, it should be relatively similar across Q3 and Q4."

Why It's Important: The company reported adjusted earnings of 9 cents per share for the quarter, matching analyst expectations. Revenue held steady year-over-year at $1.35 billion, also aligning with Wall Street projections.

Victoria's Secret also revised its full-year 2025 adjusted operating income outlook to a range of $270 million to $320 million, down from its previous estimate of $300 million to $350 million.

It anticipates a net tariff-related impact of around $50 million for the year.

It maintained its full-year 2025 revenue forecast between $6.20 billion and $6.30 billion, which is close to the consensus figure of $6.24 billion.

Price Action: Victoria's Secret & Co. shares dropped 5.36% on Wednesday but ticked up 0.48% in after-hours trading, based on Benzinga Pro data.

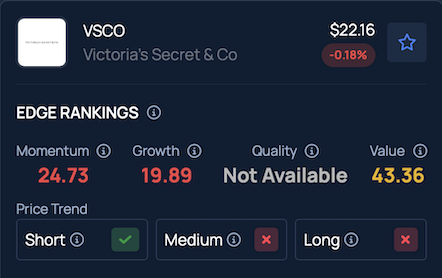

According to Benzinga's Edge Stock Rankings, VSCO shows upward momentum in the short term, though trends remain negative over medium and long-term periods. More detailed performance data is available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: JHVEPhoto / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: benzinga neuro Scott Sekella Stories That MatterEquities News Markets