These Analysts Revise Their Forecasts On Victoria's Secret Following Q1 Earnings

Victoria's Secret & Co. (NYSE:VSCO) reported in-line earnings for the first quarter on Wednesday.

The company reported adjusted earnings per share of 9 cents, which is in line with the analyst consensus estimate. Quarterly sales of $1.35 billion (flat year over year) also came in line with the Street view.

"I am pleased with the strength the business demonstrated during the March and April timeframe, which included continued momentum in our powerhouse Beauty business, ongoing strength in PINK apparel, and newness in sport and swim as we reclaim our position as a full lifestyle brand," said CEO Hillary Super.

Victoria's Secret has lowered its FY25 adjusted operating income guidance to a range of $270 million to $320 million, down from its prior forecast of $300 million to $350 million. The company also expects an estimated net tariff impact of approximately $50 million for the fiscal year.

Victoria's Secret reaffirmed its FY2025 sales guidance of $6.20 billion to $6.30 billion, compared with the $6.24 billion consensus estimate.

Victoria's Secret expects Q2 adjusted earnings per share to range between 0 cents and 15 cents, missing the 30 cents consensus estimate. The company also forecasts second-quarter sales between $1.38 billion and $1.41 billion, slightly below the $1.42 billion estimate.

Victoria's Secret shares fell 5.4% to close at $21.00 on Wednesday.

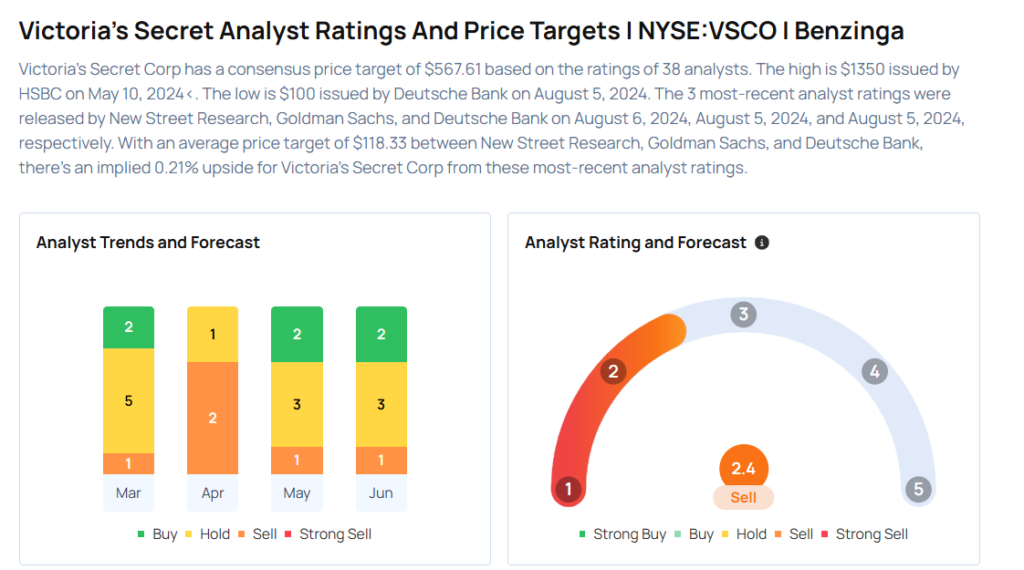

These analysts made changes to their price targets on Victoria's Secret following earnings announcement.

- B of A Securities analyst Alice Xiao maintained Victoria’s Secret with an Underperform rating and lowered the price target from $20 to $18.

- Barclays analyst Adrienne Yih maintained the stock with an Overweight rating and raised the price target from $22 to $23.

Considering buying VSCO stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for VSCO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Overweight | |

| Jan 2022 | UBS | Initiates Coverage On | Neutral | |

| Dec 2021 | Morgan Stanley | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Analyst Ratings Trading Ideas