Looking At Robinhood Markets's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Robinhood Markets (NASDAQ:HOOD).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with HOOD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 99 uncommon options trades for Robinhood Markets.

This isn't normal.

The overall sentiment of these big-money traders is split between 46% bullish and 44%, bearish.

Out of all of the special options we uncovered, 28 are puts, for a total amount of $1,322,983, and 71 are calls, for a total amount of $5,514,851.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $155.0 for Robinhood Markets over the last 3 months.

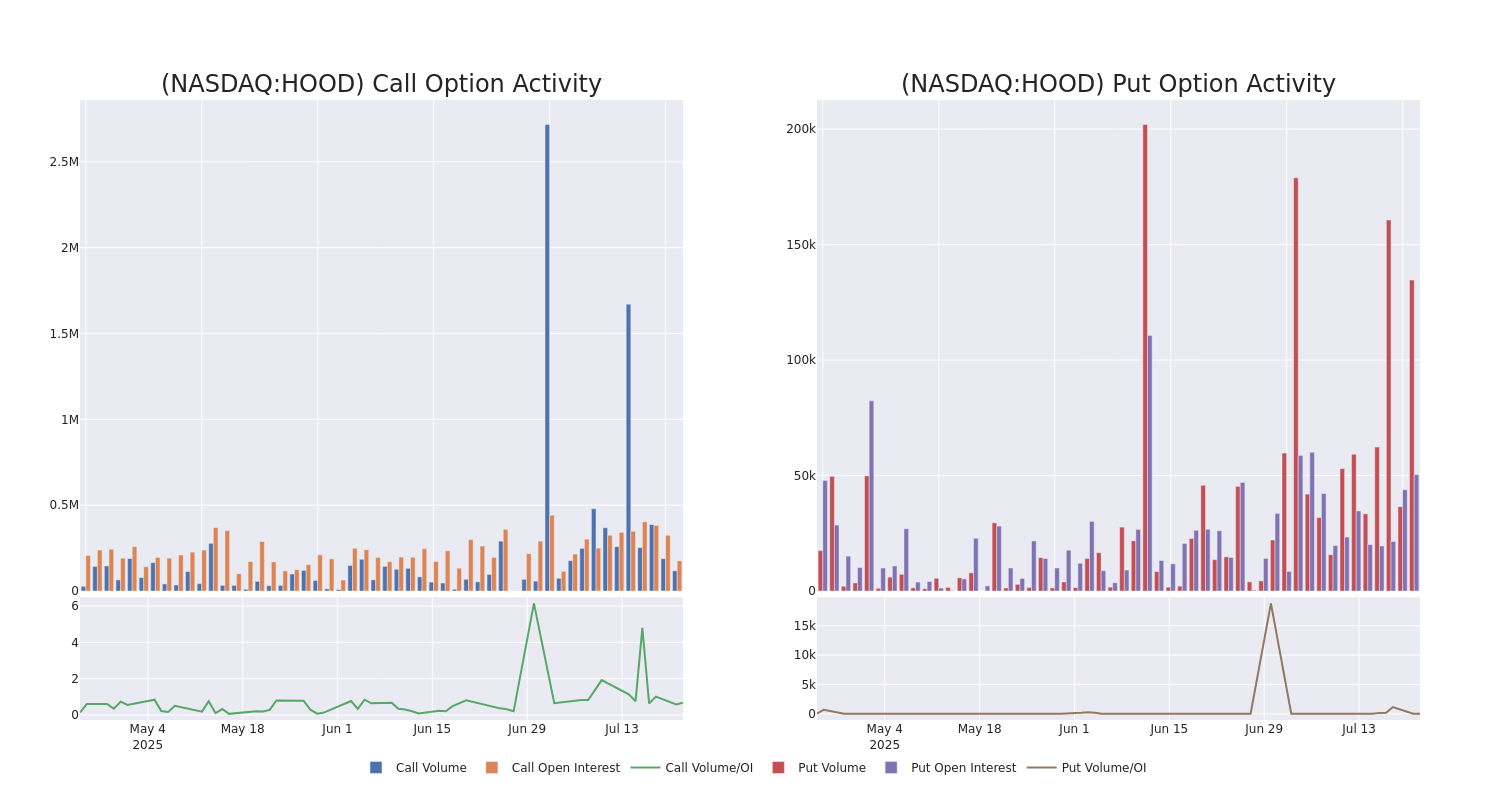

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Robinhood Markets options trades today is 4032.39 with a total volume of 252,399.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Robinhood Markets's big money trades within a strike price range of $35.0 to $155.0 over the last 30 days.

Robinhood Markets Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $21.45 | $21.4 | $21.4 | $100.00 | $308.1K | 16.1K | 7.8K |

| HOOD | CALL | SWEEP | BEARISH | 03/20/26 | $33.2 | $32.95 | $33.2 | $80.00 | $164.6K | 1.5K | 51 |

| HOOD | CALL | TRADE | BULLISH | 01/16/26 | $16.4 | $16.35 | $16.4 | $110.00 | $139.3K | 1.8K | 551 |

| HOOD | CALL | TRADE | BEARISH | 03/20/26 | $44.4 | $44.05 | $44.05 | $65.00 | $136.5K | 758 | 32 |

| HOOD | CALL | SWEEP | BULLISH | 08/01/25 | $7.7 | $7.55 | $7.67 | $101.00 | $76.7K | 627 | 301 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fraud detection, derivatives, fractional shares, recurring investments, and others.

After a thorough review of the options trading surrounding Robinhood Markets, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Robinhood Markets

- With a volume of 33,123,131, the price of HOOD is down -2.11% at $102.14.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 8 days.

What Analysts Are Saying About Robinhood Markets

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $103.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Mizuho has decided to maintain their Outperform rating on Robinhood Markets, which currently sits at a price target of $99.

* Consistent in their evaluation, an analyst from Compass Point keeps a Buy rating on Robinhood Markets with a target price of $96.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Robinhood Markets, targeting a price of $110.

* An analyst from Goldman Sachs persists with their Buy rating on Robinhood Markets, maintaining a target price of $104.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Robinhood Markets, which currently sits at a price target of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Robinhood Markets, Benzinga Pro gives you real-time options trades alerts.