Unpacking the Latest Options Trading Trends in Astera Labs

Whales with a lot of money to spend have taken a noticeably bullish stance on Astera Labs.

Looking at options history for Astera Labs (NASDAQ:ALAB) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $152,400 and 10, calls, for a total amount of $520,413.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $110.0 for Astera Labs during the past quarter.

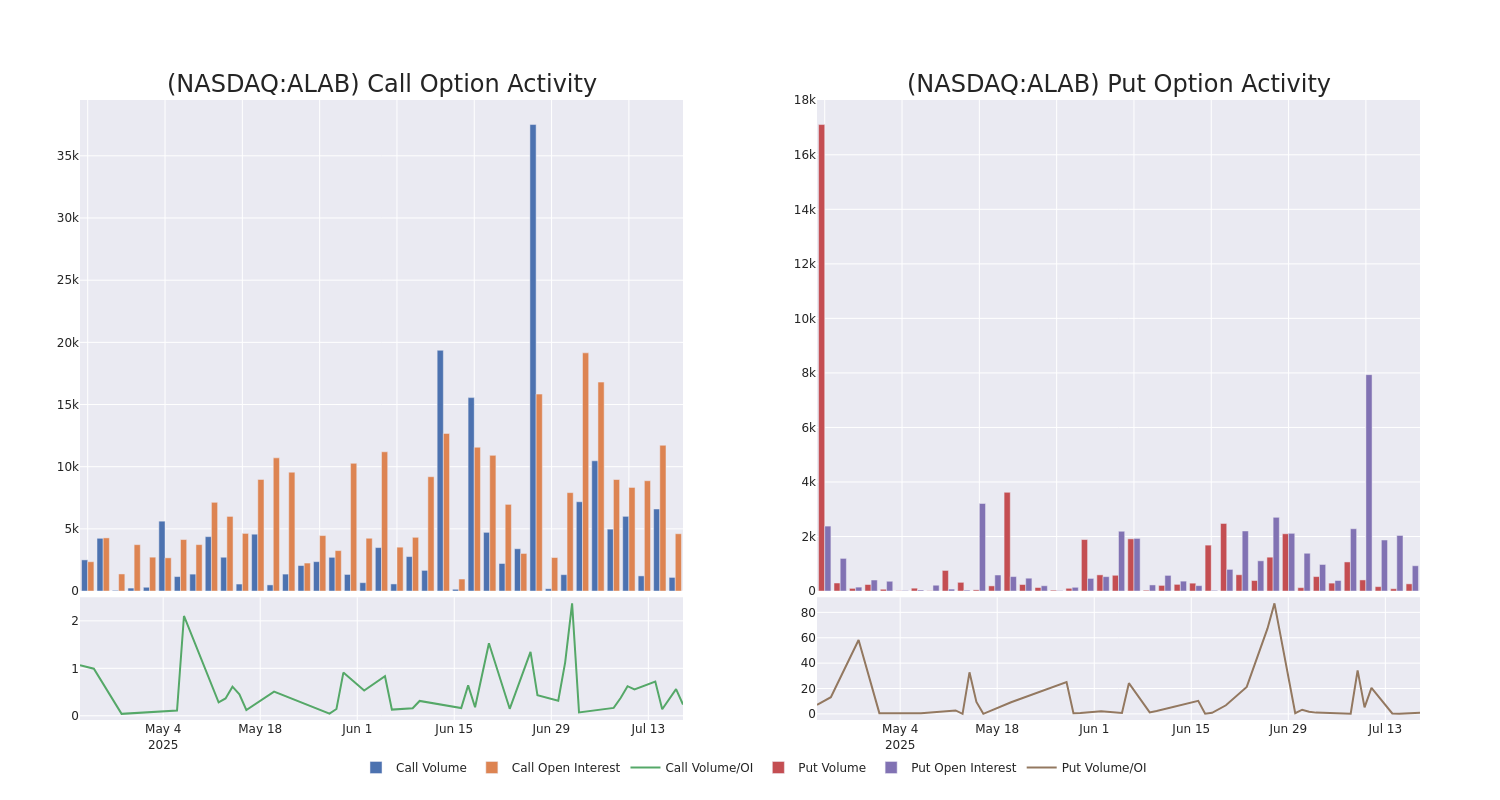

Volume & Open Interest Development

In today's trading context, the average open interest for options of Astera Labs stands at 553.6, with a total volume reaching 1,361.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Astera Labs, situated within the strike price corridor from $60.0 to $110.0, throughout the last 30 days.

Astera Labs Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | CALL | TRADE | BULLISH | 07/25/25 | $8.7 | $8.1 | $8.5 | $90.00 | $127.5K | 180 | 156 |

| ALAB | PUT | TRADE | BEARISH | 09/19/25 | $4.8 | $4.5 | $4.8 | $80.00 | $96.0K | 392 | 201 |

| ALAB | CALL | TRADE | BEARISH | 08/15/25 | $6.9 | $6.5 | $6.5 | $110.00 | $65.0K | 664 | 103 |

| ALAB | CALL | SWEEP | BEARISH | 07/25/25 | $10.4 | $9.4 | $9.62 | $90.00 | $57.4K | 180 | 257 |

| ALAB | CALL | TRADE | NEUTRAL | 09/19/25 | $14.6 | $14.2 | $14.37 | $95.00 | $43.1K | 350 | 31 |

About Astera Labs

Astera Labs Inc designs and delivers semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates semiconductor technology, microcontrollers, sensors, and software to enhance performance, scalability, and data management. The company offers products such as integrated circuits (ICs), boards, and modules, catering to hyperscalers and system OEMs. The company's solutions focus on data, network, and memory management in AI-driven platforms.

Having examined the options trading patterns of Astera Labs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Astera Labs Standing Right Now?

- Trading volume stands at 2,299,265, with ALAB's price up by 1.94%, positioned at $99.85.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 18 days.

What Analysts Are Saying About Astera Labs

1 market experts have recently issued ratings for this stock, with a consensus target price of $110.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Astera Labs, maintaining a target price of $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Astera Labs with Benzinga Pro for real-time alerts.