A Closer Look at Ouster's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Ouster (NASDAQ:OUST).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with OUST, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 13 uncommon options trades for Ouster.

This isn't normal.

The overall sentiment of these big-money traders is split between 30% bullish and 15%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $95,150, and 10 are calls, for a total amount of $409,161.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $42.0 for Ouster, spanning the last three months.

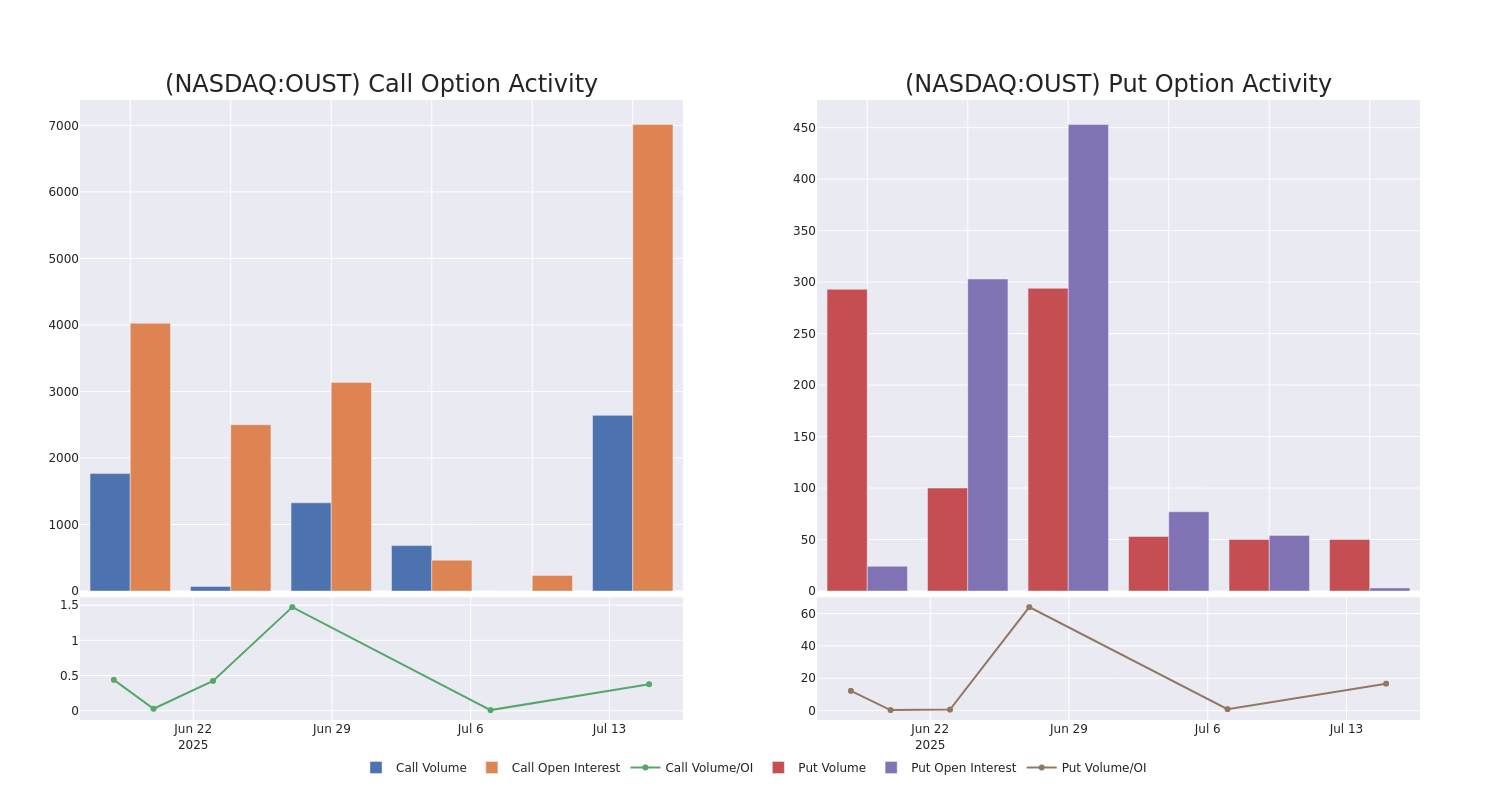

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Ouster's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Ouster's substantial trades, within a strike price spectrum from $20.0 to $42.0 over the preceding 30 days.

Ouster Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OUST | CALL | SWEEP | NEUTRAL | 01/16/26 | $6.0 | $5.7 | $5.9 | $39.00 | $67.2K | 50 | 115 |

| OUST | CALL | TRADE | NEUTRAL | 08/01/25 | $2.0 | $1.5 | $1.75 | $33.00 | $53.2K | 74 | 505 |

| OUST | CALL | SWEEP | BEARISH | 08/15/25 | $5.0 | $4.7 | $4.7 | $29.00 | $47.2K | 1.9K | 123 |

| OUST | CALL | TRADE | NEUTRAL | 01/15/27 | $13.0 | $12.0 | $12.5 | $35.00 | $41.2K | 15 | 51 |

| OUST | CALL | SWEEP | BULLISH | 08/01/25 | $1.0 | $0.95 | $1.0 | $36.00 | $38.6K | 0 | 386 |

About Ouster

Ouster Inc is a provider of lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries. Ouster's products include high-resolution scanning and solid-state digital lidar sensors, Velodyne Lidar sensors, and software solutions. The company operates in the Americas, Asia and Pacific, Europe, Middle East, and Africa regions. It derives maximum revenue from Americas.

After a thorough review of the options trading surrounding Ouster, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Ouster

- Currently trading with a volume of 1,710,592, the OUST's price is up by 1.1%, now at $29.35.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 21 days.

Professional Analyst Ratings for Ouster

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $34.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Ouster, which currently sits at a price target of $34.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Ouster with Benzinga Pro for real-time alerts.