A Glimpse Into The Expert Outlook On Keysight Techs Through 4 Analysts

4 analysts have shared their evaluations of Keysight Techs (NYSE:KEYS) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 0 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 1 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

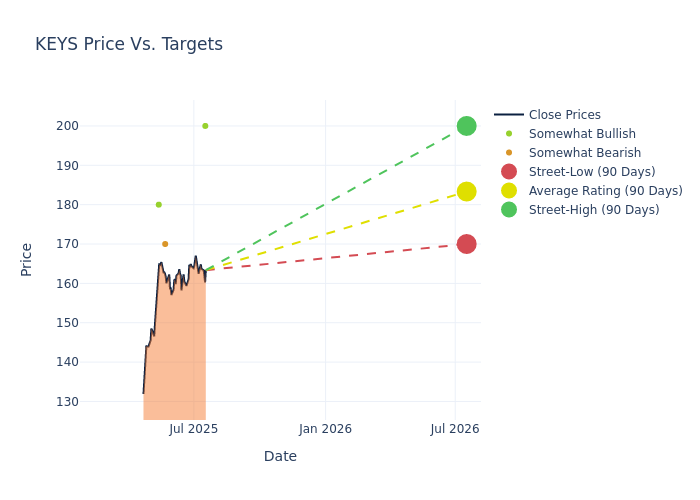

In the assessment of 12-month price targets, analysts unveil insights for Keysight Techs, presenting an average target of $181.75, a high estimate of $200.00, and a low estimate of $170.00. This current average has increased by 8.51% from the previous average price target of $167.50.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Keysight Techs by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samik Chatterjee | JP Morgan | Raises | Overweight | $200.00 | $177.00 |

| David Ridley-Lane | B of A Securities | Raises | Underperform | $170.00 | $165.00 |

| Samik Chatterjee | JP Morgan | Raises | Overweight | $177.00 | $172.00 |

| Meta Marshall | Morgan Stanley | Raises | Overweight | $180.00 | $156.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Keysight Techs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Keysight Techs compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Keysight Techs's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Keysight Techs's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Keysight Techs analyst ratings.

All You Need to Know About Keysight Techs

Keysight Technologies is a leader in the field of testing and measurement, helping electronics OEMs and suppliers alike bring products to market to fit industry standards and specifications. Keysight specializes in the communications market, but also supplies into the government, automotive, industrial, and semiconductor manufacturing markets. Keysight's solutions include testing tools, analytical software, and services. The firm's stated objective is to reduce time to market and improve efficiency at its more than 30,000 customers.

Breaking Down Keysight Techs's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining Keysight Techs's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.4% as of 30 April, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Keysight Techs's net margin excels beyond industry benchmarks, reaching 19.68%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.82%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Keysight Techs's ROA excels beyond industry benchmarks, reaching 2.58%. This signifies efficient management of assets and strong financial health.

Debt Management: Keysight Techs's debt-to-equity ratio stands notably higher than the industry average, reaching 0.5. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for KEYS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Upgrades | Hold | Buy |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Dec 2021 | JP Morgan | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings