A Closer Look at Lennar's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Lennar.

Looking at options history for Lennar (NYSE:LEN) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 18% of the investors opened trades with bullish expectations and 81% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $545,925 and 2, calls, for a total amount of $182,200.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $120.0 for Lennar during the past quarter.

Insights into Volume & Open Interest

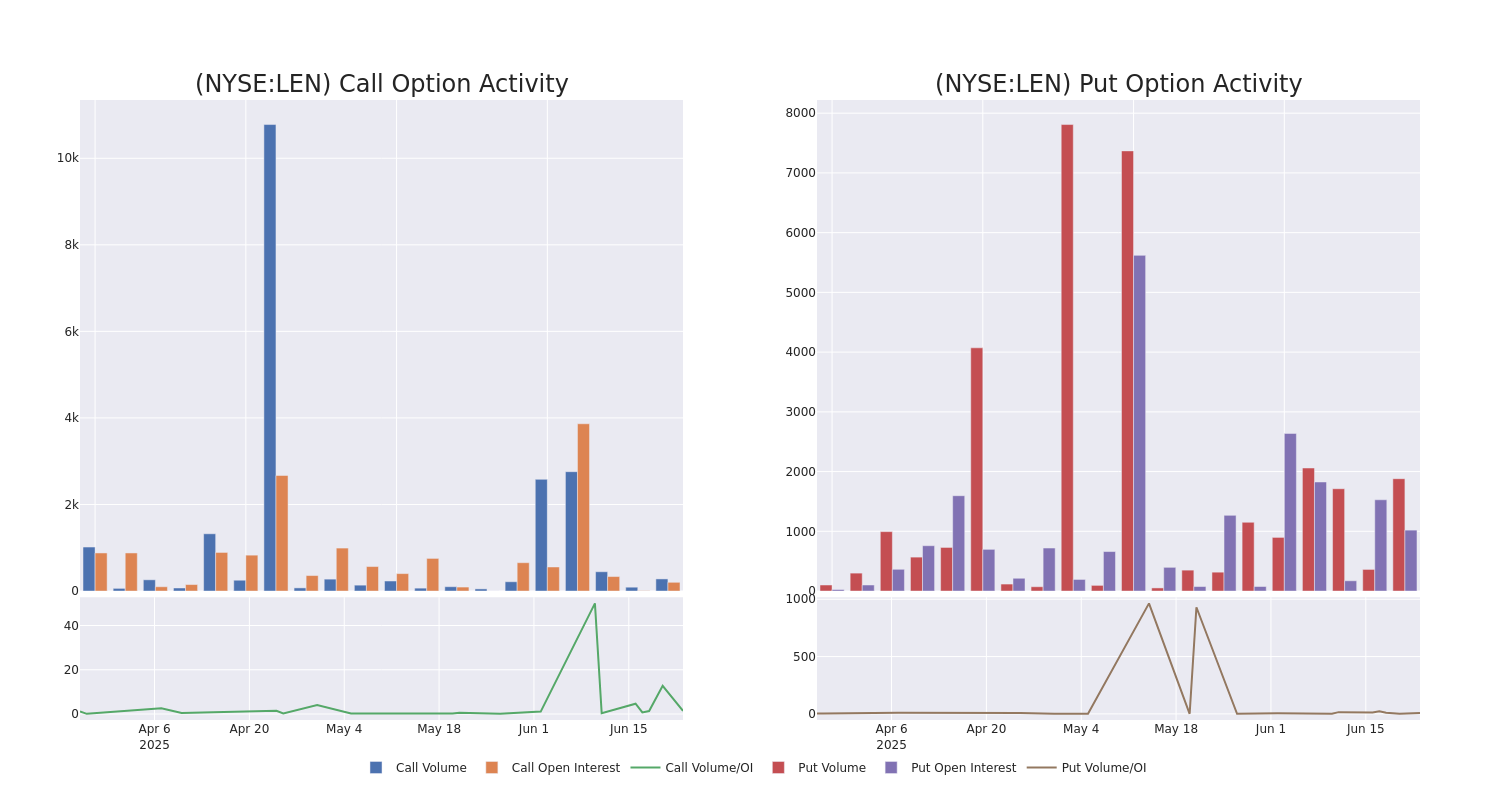

In today's trading context, the average open interest for options of Lennar stands at 305.5, with a total volume reaching 2,161.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lennar, situated within the strike price corridor from $95.0 to $120.0, throughout the last 30 days.

Lennar Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LEN | CALL | TRADE | BEARISH | 06/27/25 | $14.0 | $12.7 | $13.0 | $95.00 | $156.0K | 202 | 200 |

| LEN | PUT | SWEEP | BULLISH | 09/19/25 | $14.9 | $14.6 | $14.6 | $120.00 | $99.2K | 214 | 265 |

| LEN | PUT | SWEEP | BEARISH | 09/19/25 | $14.9 | $14.6 | $14.86 | $120.00 | $98.1K | 214 | 331 |

| LEN | PUT | SWEEP | BEARISH | 09/19/25 | $11.9 | $11.6 | $11.9 | $115.00 | $65.4K | 210 | 165 |

| LEN | PUT | SWEEP | BEARISH | 09/19/25 | $11.9 | $11.5 | $11.78 | $115.00 | $65.2K | 210 | 55 |

About Lennar

Lennar is one of the largest public homebuilders in the United States. The company's homebuilding operations target first-time, move-up, active adult, and luxury homebuyers mainly under the Lennar brand name. Lennar's financial-services segment provides mortgage financing and related services to its homebuyers. Miami-based Lennar is also involved in multifamily and single-family for-rent construction and has invested in numerous housing-related technology startups.

Present Market Standing of Lennar

- With a trading volume of 1,191,526, the price of LEN is up by 1.8%, reaching $108.34.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 87 days from now.

Professional Analyst Ratings for Lennar

5 market experts have recently issued ratings for this stock, with a consensus target price of $108.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Lennar with a target price of $105.

* An analyst from Evercore ISI Group persists with their In-Line rating on Lennar, maintaining a target price of $114.

* In a cautious move, an analyst from Wedbush downgraded its rating to Neutral, setting a price target of $130.

* An analyst from Barclays persists with their Equal-Weight rating on Lennar, maintaining a target price of $95.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Lennar, targeting a price of $98.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lennar with Benzinga Pro for real-time alerts.