Etsy's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Etsy.

Looking at options history for Etsy (NASDAQ:ETSY) we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $80,790 and 14, calls, for a total amount of $3,212,253.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $22.5 to $75.0 for Etsy during the past quarter.

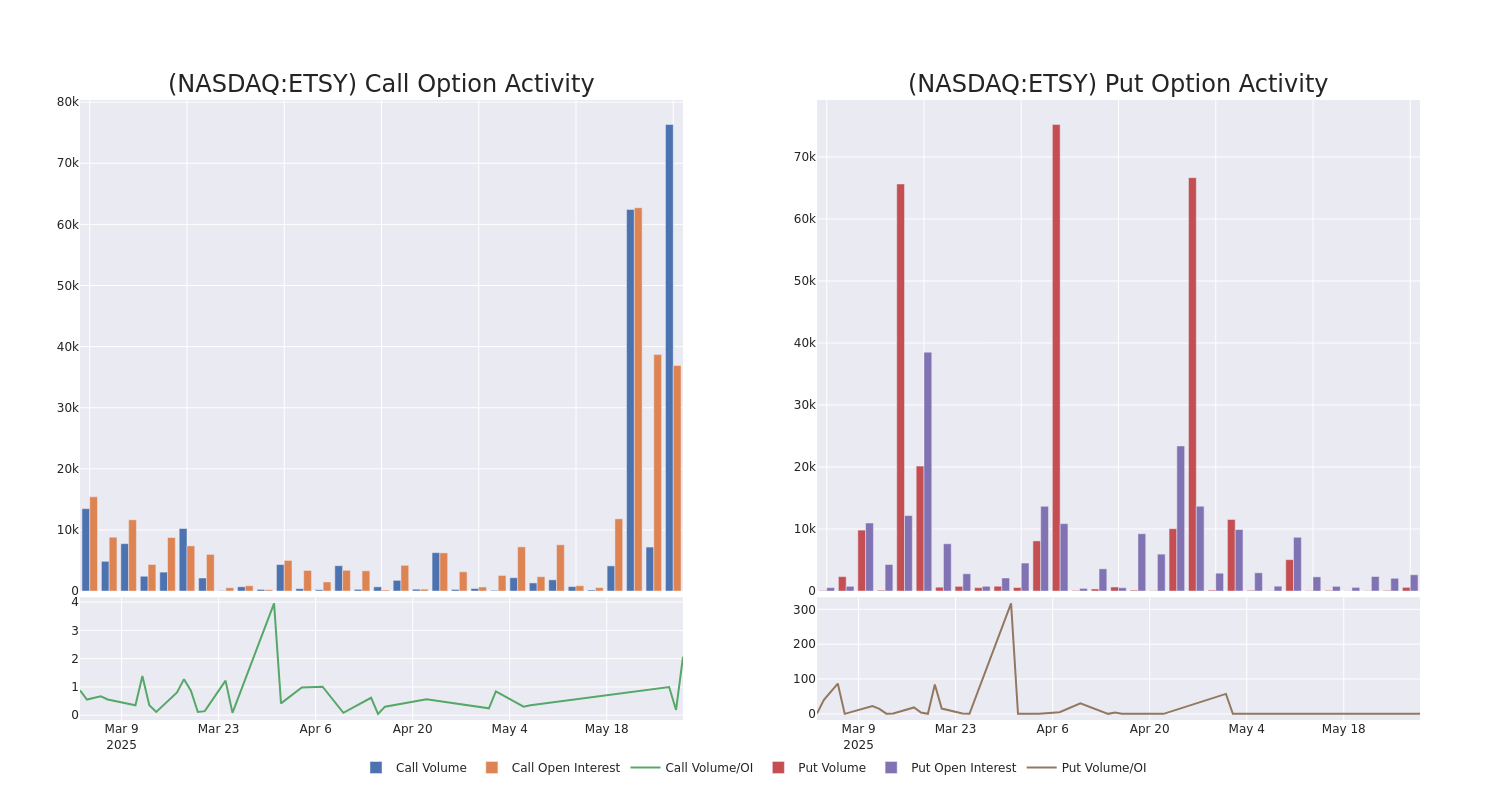

Volume & Open Interest Development

In today's trading context, the average open interest for options of Etsy stands at 3594.91, with a total volume reaching 76,933.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Etsy, situated within the strike price corridor from $22.5 to $75.0, throughout the last 30 days.

Etsy Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | CALL | TRADE | BULLISH | 12/19/25 | $17.25 | $15.7 | $16.7 | $40.00 | $1.4M | 1.7K | 989 |

| ETSY | CALL | SWEEP | BULLISH | 12/19/25 | $13.65 | $13.3 | $13.53 | $45.00 | $1.1M | 971 | 850 |

| ETSY | CALL | TRADE | BEARISH | 09/19/25 | $2.12 | $2.09 | $2.09 | $65.00 | $104.5K | 966 | 501 |

| ETSY | CALL | SWEEP | BULLISH | 06/20/25 | $5.0 | $4.85 | $5.0 | $50.00 | $95.5K | 11.1K | 234 |

| ETSY | CALL | SWEEP | BULLISH | 01/16/26 | $2.29 | $2.0 | $2.1 | $75.00 | $75.6K | 1.5K | 360 |

About Etsy

Etsy operates a top-10 e-commerce marketplace in the US and the UK, with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods. With $12.5 billion in 2024 consolidated gross merchandise volume, Etsy has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels. As of the end of 2024, the firm connected more than 95 million buyers and 8 million sellers on its marketplace properties: Etsy, Reverb (musical equipment), and Depop (clothing resale).

After a thorough review of the options trading surrounding Etsy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Etsy Standing Right Now?

- With a trading volume of 5,571,406, the price of ETSY is up by 2.2%, reaching $52.58.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 62 days from now.

Professional Analyst Ratings for Etsy

5 market experts have recently issued ratings for this stock, with a consensus target price of $42.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B. Riley Securities persists with their Buy rating on Etsy, maintaining a target price of $55.

* An analyst from Morgan Stanley persists with their Underweight rating on Etsy, maintaining a target price of $38.

* An analyst from Wells Fargo persists with their Underweight rating on Etsy, maintaining a target price of $40.

* An analyst from Goldman Sachs has decided to maintain their Sell rating on Etsy, which currently sits at a price target of $31.

* An analyst from Cantor Fitzgerald has decided to maintain their Neutral rating on Etsy, which currently sits at a price target of $47.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Etsy, Benzinga Pro gives you real-time options trades alerts.