Tom Lee Says Michael Saylor-Led Strategy's 35x Surge Wasn't Just Bitcoin — Treasury Moves 'Far More Significant' Than Token Price Gain

Wall Street strategist Tom Lee said Thursday that the astronomical jump in Strategy Inc. (NASDAQ:MSTR) shares was due not just to the rise in Bitcoin (CRYPTO: BTC) but also to the financial maneuvers it adopted.

What happened: In an X thread, Lee highlighted how the stock of the Michael Saylor-led firm skyrocketed from $13 to over $450 after switching to a Bitcoin treasury strategy five years ago.

The Head of Research at Fundstrat said that out of the 35x spike, 11x was due to Bitcoin's price surging from $11,000 to $118,000, while the treasury strategy contributed an additional 25x rise.

"Treasury strategy far more significant than token price gain," Lee said.

See Also: Bitcoin Treasury Companies’ Play Like ‘Ponzi Built On A Pyramid,’ Says Peter Schiff; Economist Warns ‘Wild Centralized Speculation’ Eroding BTC’s Foundation

Why It Matters: Strategy has pioneered Bitcoin's corporate adoption, building its reserve with proceeds from common stock, preferred stock, and convertible bond issuances. The firm held a stash of more than 600,000 BTC, worth $72 billion as of this writing, according to bitcointreasuries.net.

Lee said Strategy employed these strategies to increase the Bitcoin held per share, also known as the “Bitcoin Yield,” as described by the firm. Year-to-date, this yield has grown 20%.

Notably, Lee recently took over as chairman of BitMine Immersion Technologies (AMEX:BMNR), a Bitcoin mining firm that will transition to an Ethereum (CRYPTO: ETH)-focused treasury company, adopting ETH as its primary reserve asset.

Price Action: At the time of writing, Bitcoin was exchanging hands at $120,621.13, up 1.57% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy were up 0.64% in after-hours trading after closing 1% lower at $451.34 during Thursday's regular trading session. The stock has risen over 55% year-to-date.

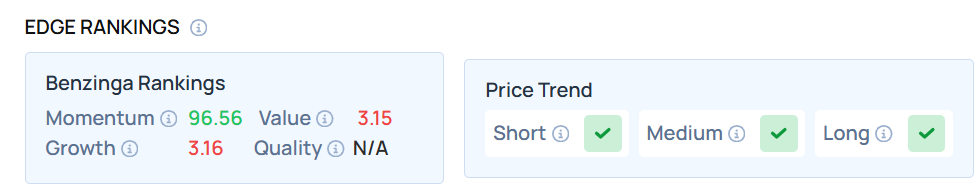

MSTR recorded a very high Momentum score as of this writing. If you are looking to filter out similar high-momentum stocks for your portfolio, Benzinga Edge Stock Rankings might be of some help.

Read Next:

Photo courtesy: PJ McDonnell / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency News Markets