Wells Fargo's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Wells Fargo (NYSE:WFC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WFC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Wells Fargo. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 44% bearish. Among these notable options, 2 are puts, totaling $66,049, and 7 are calls, amounting to $390,120.

Expected Price Movements

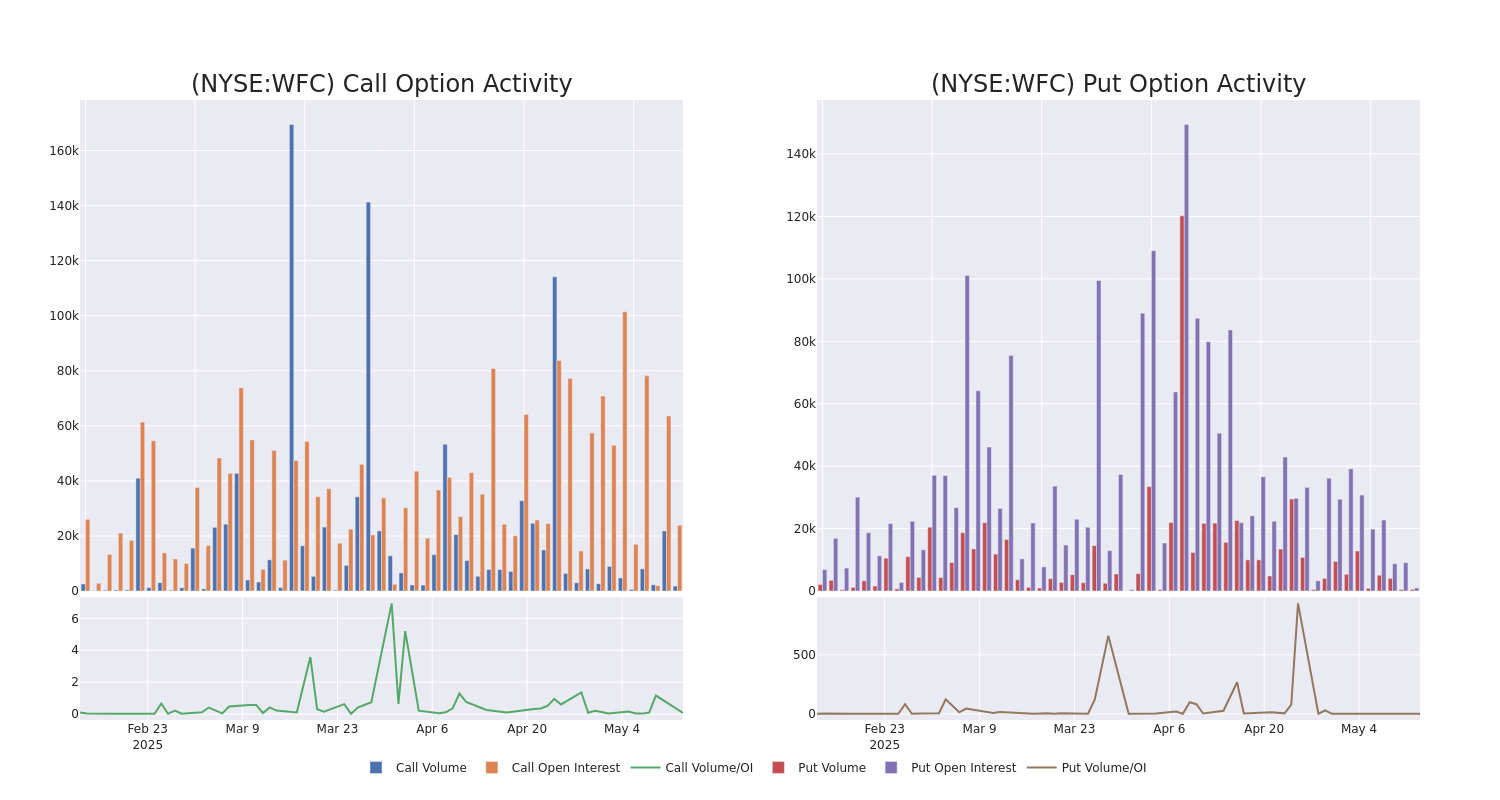

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $77.0 for Wells Fargo during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Wells Fargo options trades today is 3553.57 with a total volume of 2,315.00.

42-Year Market Veteran Matt Maley's Position Ratio Strategy

Matt's hedging approach protects profits while keeping the door open for even bigger upside. It’s the same strategy he used to lock in major wins on names like WOLF, SOXS, and GDX just last week — while actively positioning for what’s next. Designed to stretch gains and stay aggressive, even in choppy markets, this approach gives traders an edge most never see. And right now, you can get access to the next trade for free. Get started right here.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Wells Fargo's big money trades within a strike price range of $50.0 to $77.0 over the last 30 days.

Wells Fargo Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | SWEEP | BULLISH | 12/19/25 | $10.45 | $10.35 | $10.45 | $70.00 | $99.2K | 151 | 125 |

| WFC | CALL | SWEEP | BULLISH | 05/30/25 | $0.81 | $0.79 | $0.8 | $77.00 | $79.1K | 20.1K | 993 |

| WFC | CALL | SWEEP | BEARISH | 05/16/25 | $2.34 | $2.08 | $2.15 | $74.00 | $64.5K | 2.6K | 518 |

| WFC | CALL | SWEEP | NEUTRAL | 06/20/25 | $26.35 | $25.05 | $25.78 | $50.00 | $51.5K | 137 | 23 |

| WFC | CALL | SWEEP | BULLISH | 03/20/26 | $10.55 | $10.4 | $10.55 | $72.50 | $43.2K | 726 | 70 |

About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the US

Following our analysis of the options activities associated with Wells Fargo, we pivot to a closer look at the company's own performance.

Current Position of Wells Fargo

- With a trading volume of 3,740,966, the price of WFC is up by 1.26%, reaching $75.82.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 62 days from now.

What Analysts Are Saying About Wells Fargo

In the last month, 4 experts released ratings on this stock with an average target price of $78.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on Wells Fargo with a target price of $75.

* Maintaining their stance, an analyst from Raymond James continues to hold a Strong Buy rating for Wells Fargo, targeting a price of $78.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Wells Fargo, targeting a price of $87.

* An analyst from Truist Securities persists with their Buy rating on Wells Fargo, maintaining a target price of $73.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Wells Fargo with Benzinga Pro for real-time alerts.

3 Income Stocks Already Paying Out Big As Markets Rebound

The market’s gaining steam – and so is your opportunity to lock in serious income. Our ‘Easy Income Portfolio’ has been paying out a reliable 10%+ yield for the past month, even when the market was getting crushed. Want the top three stocks fueling its success? Get all 3 top stocks here.