These Analysts Revise Their Forecasts On Vail Resorts After Q3 Results

Vail Resorts Inc (NYSE:MTN) reported mixed financial results for the third quarter on Thursday after the bell.

Vail Resorts reported third-quarter revenue of $1.29 billion, narrowly missing estimates of $1.3 billion, according to Benzinga Pro. The company reported third-quarter earnings of $10.54 per share, beating estimates of $10.12 per share.

"Results in the quarter reflect the stability provided by our season pass program as Resort net revenue, excluding Crans-Montana, remained consistent with the prior year even as visitation declined 7%," said Rob Katz, CEO of Vail Resorts.

The company expects fiscal 2025 net income attributable to Vail Resorts to be between $264 million and $298 million, and Resort Reported EBITDA for fiscal 2025 to be between $831 million and $851 million.

Vail Resorts shares dipped 3.9% to trade at $149.00 on Friday.

These analysts made changes to their price targets on Vail Resorts following earnings announcement.

Get Real-Time Trade Setups for Today’s Volatile Market

Spikes in oil, surprise job numbers, and geopolitical tensions are triggering rapid market moves. Chris Capre’s Trading Waves system gives you real-time trade alerts designed to capture high-probability setups during these fast swings. Start your free trial now and get the trades Chris is watching today.

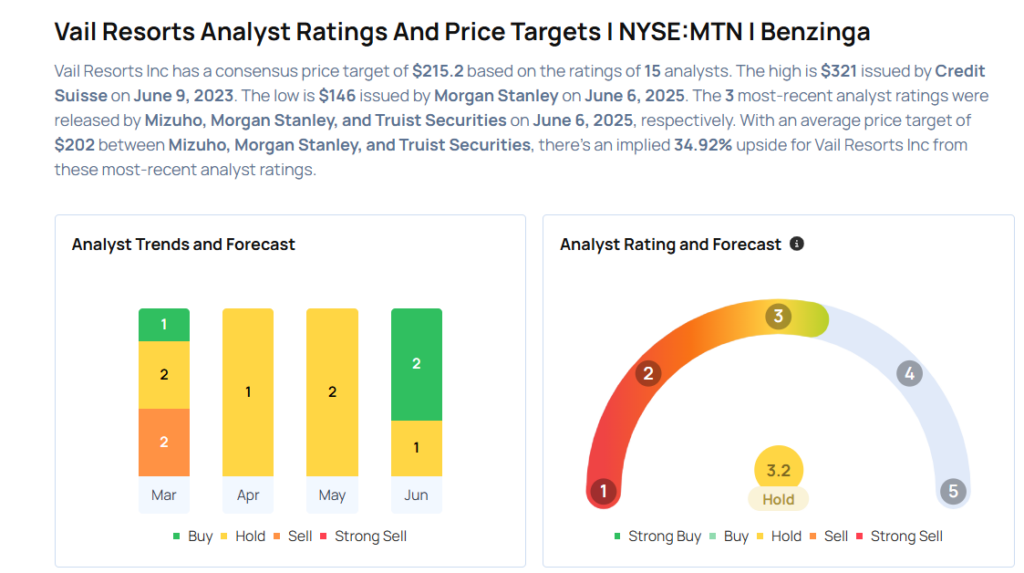

- Truist Securities analyst Patrick Scholes maintained Vail Resorts with a Buy and lowered the price target from $247 to $244.

- Morgan Stanley analyst Megan Alexander maintained the stock with an Equal-Weight rating and cut the price target from $152 to $146.

- Mizuho analyst Ben Chaiken maintained Vail Resorts with an Outperform rating and raised the price target from $215 to $216.

Considering buying MTN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for MTN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Jan 2022 | JP Morgan | Maintains | Neutral | |

| Dec 2021 | Deutsche Bank | Maintains | Hold |

Before They Breakout: Get 5 Dark Horse Stock Picks Every Friday

Our ‘Whisper Index’ flagged biotech sleeper Insmed before its 60% surge. Every Friday, it uncovers five more stocks showing the same breakout patterns.Don’t miss this week’s picks—unlock Friday’s ‘Whisper Index’ now.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas