Earnings Preview: Bel Fuse

Bel Fuse (NASDAQ:BELFB) will release its quarterly earnings report on Thursday, 2025-07-24. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Bel Fuse to report an earnings per share (EPS) of $1.19.

Bel Fuse bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

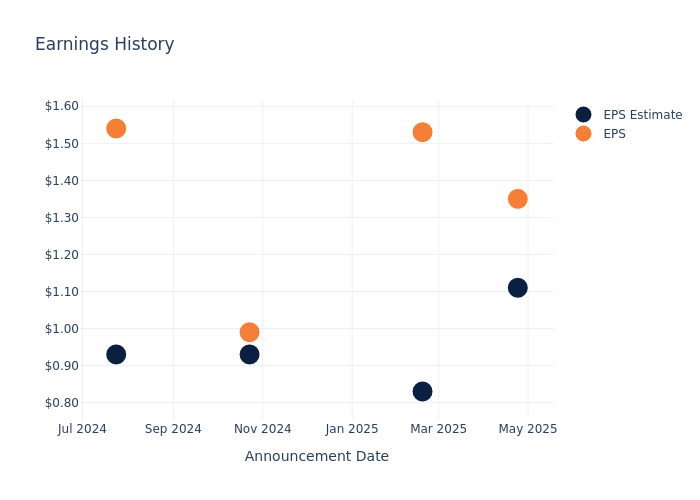

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.24, leading to a 1.5% increase in the share price the following trading session.

Here's a look at Bel Fuse's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.11 | 0.83 | 0.93 | 0.93 |

| EPS Actual | 1.35 | 1.53 | 0.99 | 1.54 |

| Price Change % | 1.0% | -1.0% | -0.0% | 10.0% |

Market Performance of Bel Fuse's Stock

Shares of Bel Fuse were trading at $106.0 as of July 22. Over the last 52-week period, shares are up 46.9%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Bel Fuse

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Bel Fuse.

The consensus rating for Bel Fuse is Outperform, derived from 5 analyst ratings. An average one-year price target of $102.2 implies a potential 3.58% downside.

Comparing Ratings with Competitors

This comparison focuses on the analyst ratings and average 1-year price targets of Rogers, Knowles and Airgain, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Rogers, with an average 1-year price target of $85.0, suggesting a potential 19.81% downside.

- Analysts currently favor an Outperform trajectory for Knowles, with an average 1-year price target of $22.0, suggesting a potential 79.25% downside.

- Analysts currently favor an Buy trajectory for Airgain, with an average 1-year price target of $7.0, suggesting a potential 93.4% downside.

Overview of Peer Analysis

In the peer analysis summary, key metrics for Rogers, Knowles and Airgain are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Bel Fuse | Outperform | 18.85% | $58.82M | 4.85% |

| Rogers | Buy | -10.73% | $57M | -0.11% |

| Knowles | Outperform | -0.83% | $53.30M | -0.26% |

| Airgain | Buy | -15.59% | $5.16M | -5.04% |

Key Takeaway:

Bel Fuse outperforms its peers in terms of Revenue Growth and Gross Profit, ranking at the top. However, it lags behind in terms of Return on Equity, placing in the middle among its peers.

Unveiling the Story Behind Bel Fuse

Bel Fuse Inc designs and manufactures electronic components that protect and connect electronic circuits. Its product portfolio is divided into three categories: magnetic solutions, power solutions & protection, and connectivity solutions. These products are used for the computer, networking, telecommunications, transportation and defense/aerospace, automotive, medical, and consumer electronics industries. Its geographical segments are the United States, Macao, United Kingdom, Slovakia, Germany, Switzerland, and All other foreign countries. Majority of the revenue is derived from United States.

A Deep Dive into Bel Fuse's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Bel Fuse displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 18.85%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: Bel Fuse's net margin is impressive, surpassing industry averages. With a net margin of 11.74%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Bel Fuse's ROE excels beyond industry benchmarks, reaching 4.85%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Bel Fuse's ROA excels beyond industry benchmarks, reaching 1.89%. This signifies efficient management of assets and strong financial health.

Debt Management: Bel Fuse's debt-to-equity ratio stands notably higher than the industry average, reaching 0.82. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Bel Fuse visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.