Newmont's Earnings: A Preview

Newmont (NYSE:NEM) will release its quarterly earnings report on Thursday, 2025-07-24. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Newmont to report an earnings per share (EPS) of $1.12.

Anticipation surrounds Newmont's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

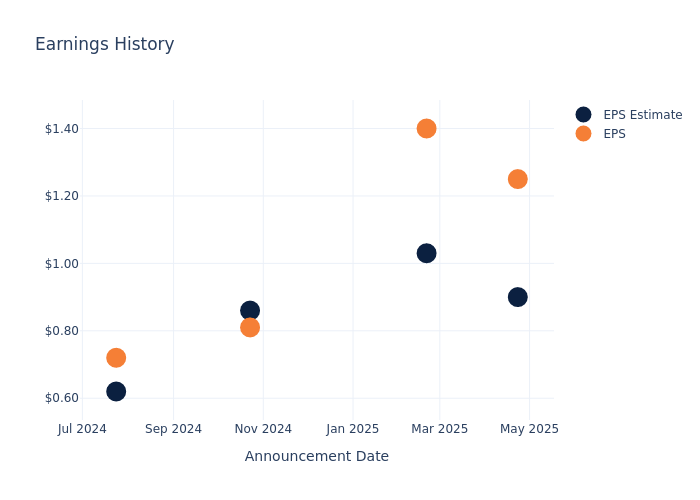

Overview of Past Earnings

The company's EPS beat by $0.35 in the last quarter, leading to a 4.8% increase in the share price on the following day.

Here's a look at Newmont's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.90 | 1.03 | 0.86 | 0.62 |

| EPS Actual | 1.25 | 1.40 | 0.81 | 0.72 |

| Price Change % | 5.0% | -6.0% | -15.0% | -4.0% |

Market Performance of Newmont's Stock

Shares of Newmont were trading at $61.7 as of July 22. Over the last 52-week period, shares are up 35.43%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Newmont

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Newmont.

A total of 3 analyst ratings have been received for Newmont, with the consensus rating being Buy. The average one-year price target stands at $71.67, suggesting a potential 16.16% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Anglogold Ashanti, Royal Gold and Coeur Mining, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Anglogold Ashanti, with an average 1-year price target of $53.1, suggesting a potential 13.94% downside.

- Analysts currently favor an Neutral trajectory for Royal Gold, with an average 1-year price target of $206.0, suggesting a potential 233.87% upside.

- Analysts currently favor an Buy trajectory for Coeur Mining, with an average 1-year price target of $12.0, suggesting a potential 80.55% downside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Anglogold Ashanti, Royal Gold and Coeur Mining are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Newmont | Buy | 24.53% | $2.31B | 6.18% |

| Anglogold Ashanti | Buy | 67.63% | $839M | 6.61% |

| Royal Gold | Neutral | 29.91% | $134.17M | 3.59% |

| Coeur Mining | Buy | 69.00% | $112.70M | 1.72% |

Key Takeaway:

Newmont ranks highest in gross profit among its peers. It is in the middle for consensus rating and revenue growth. However, it has the lowest return on equity compared to its peers.

All You Need to Know About Newmont

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to sell roughly 5.6 million ounces of gold in 2025 from its core mines after selling six higher-cost, smaller mines. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2024.

Key Indicators: Newmont's Financial Health

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Newmont displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 24.53%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: Newmont's net margin is impressive, surpassing industry averages. With a net margin of 37.74%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Newmont's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.18% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Newmont's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.38%, the company showcases efficient use of assets and strong financial health.

Debt Management: Newmont's debt-to-equity ratio stands notably higher than the industry average, reaching 0.26. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Newmont visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.