Exploring Alphabet's Earnings Expectations

Alphabet (NASDAQ:GOOGL) will release its quarterly earnings report on Wednesday, 2025-07-23. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Alphabet to report an earnings per share (EPS) of $2.16.

The announcement from Alphabet is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

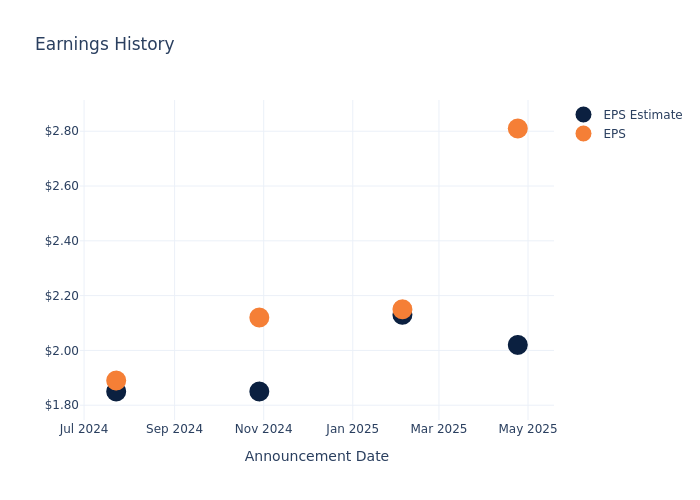

Performance in Previous Earnings

Last quarter the company beat EPS by $0.79, which was followed by a 1.68% increase in the share price the next day.

Here's a look at Alphabet's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.02 | 2.13 | 1.85 | 1.85 |

| EPS Actual | 2.81 | 2.15 | 2.12 | 1.89 |

| Price Change % | 2.0% | -7.000000000000001% | 3.0% | -5.0% |

Tracking Alphabet's Stock Performance

Shares of Alphabet were trading at $190.1 as of July 21. Over the last 52-week period, shares are up 9.85%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Alphabet

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Alphabet.

With 30 analyst ratings, Alphabet has a consensus rating of Buy. The average one-year price target is $199.47, indicating a potential 4.93% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Meta Platforms, Reddit and Pinterest, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Meta Platforms, with an average 1-year price target of $737.51, suggesting a potential 287.96% upside.

- Analysts currently favor an Neutral trajectory for Reddit, with an average 1-year price target of $151.33, suggesting a potential 20.39% downside.

- Analysts currently favor an Buy trajectory for Pinterest, with an average 1-year price target of $41.47, suggesting a potential 78.19% downside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Meta Platforms, Reddit and Pinterest are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Alphabet | Buy | 12.04% | $53.87B | 10.30% |

| Meta Platforms | Outperform | 16.07% | $34.74B | 9.05% |

| Neutral | 61.49% | $355.27M | 1.20% | |

| Buy | 15.54% | $655.72M | 0.19% |

Key Takeaway:

Alphabet ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth and Consensus rating.

Delving into Alphabet's Background

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google's subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google's cloud computing platform, or GCP, accounts for roughly 10% of Alphabet's revenue with the firm's investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

Breaking Down Alphabet's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Alphabet displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 12.04%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Net Margin: Alphabet's net margin excels beyond industry benchmarks, reaching 38.28%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Alphabet's ROE stands out, surpassing industry averages. With an impressive ROE of 10.3%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Alphabet's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.46% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Alphabet's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.07.

To track all earnings releases for Alphabet visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.