Assessing Polaris: Insights From 7 Financial Analysts

7 analysts have shared their evaluations of Polaris (NYSE:PII) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 6 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 1 |

| 3M Ago | 0 | 0 | 4 | 0 | 0 |

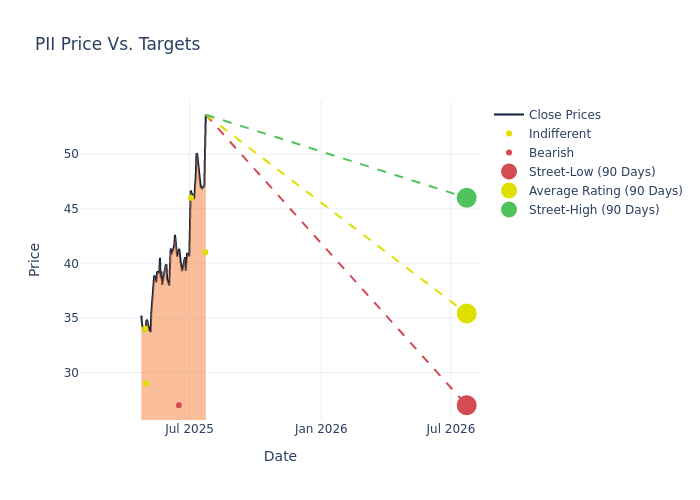

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $35.43, along with a high estimate of $46.00 and a low estimate of $27.00. This current average represents a 1.2% decrease from the previous average price target of $35.86.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Polaris. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Stember | Roth Capital | Raises | Neutral | $41.00 | $32.00 |

| Craig Kennison | Baird | Raises | Neutral | $46.00 | $38.00 |

| James Hardiman | Citigroup | Raises | Sell | $27.00 | $23.00 |

| Craig Kennison | Baird | Raises | Neutral | $38.00 | $33.00 |

| Megan Alexander | Morgan Stanley | Lowers | Equal-Weight | $29.00 | $31.00 |

| Sabahat Khan | RBC Capital | Lowers | Sector Perform | $34.00 | $54.00 |

| Craig Kennison | Baird | Lowers | Neutral | $33.00 | $40.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Polaris. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Polaris compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Polaris's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Polaris's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Polaris analyst ratings.

Delving into Polaris's Background

Polaris designs and manufactures off-road vehicles, including all-terrain vehicles and side-by-side vehicles for recreational and utility purposes, snowmobiles, and on-road vehicles, including motorcycles, along with the related replacement parts, garments, and accessories. The firm entered the marine market after acquiring Boat Holdings in 2018, offering exposure to another segment of the outdoor lifestyle market. Polaris products are retailed through more than 2,500 dealers in North America and 1,500 international dealers as well as more than 25 subsidiaries and 90 distributors in more than 100 countries outside North America.

Key Indicators: Polaris's Financial Health

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Decline in Revenue: Over the 3M period, Polaris faced challenges, resulting in a decline of approximately -11.55% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Polaris's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -4.35%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Polaris's ROE excels beyond industry benchmarks, reaching -5.31%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Polaris's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -1.22%, the company showcases efficient use of assets and strong financial health.

Debt Management: Polaris's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.78, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PII

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Citigroup | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | Raymond James | Maintains | Strong Buy |

Posted-In: BZI-AARAnalyst Ratings