MP Materials Stock: A Deep Dive Into Analyst Perspectives (10 Ratings)

Throughout the last three months, 10 analysts have evaluated MP Materials (NYSE:MP), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

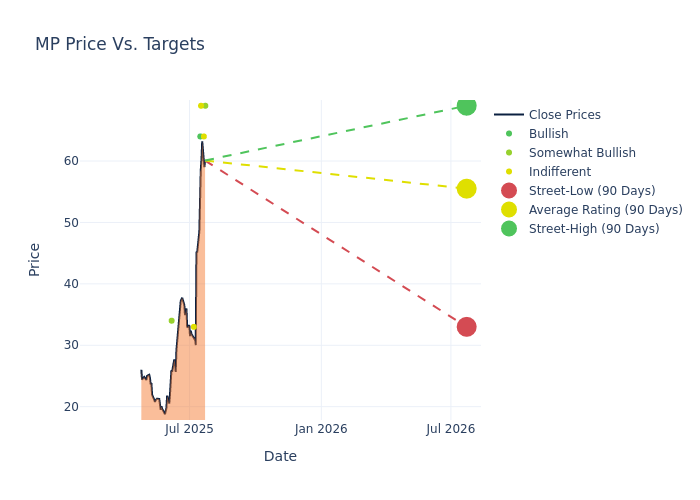

In the assessment of 12-month price targets, analysts unveil insights for MP Materials, presenting an average target of $46.5, a high estimate of $69.00, and a low estimate of $18.00. Marking an increase of 55.0%, the current average surpasses the previous average price target of $30.00.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive MP Materials. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ben Kallo | Baird | Raises | Outperform | $69.00 | $52.00 |

| Bill Peterson | JP Morgan | Raises | Neutral | $64.00 | $18.00 |

| Corinne Blanchard | Deutsche Bank | Raises | Hold | $69.00 | $20.00 |

| George Gianarikas | Canaccord Genuity | Raises | Buy | $64.00 | $55.00 |

| George Gianarikas | Canaccord Genuity | Raises | Buy | $55.00 | $27.00 |

| Laurence Alexander | Jefferies | Raises | Hold | $33.00 | $32.00 |

| Ben Kallo | Baird | Raises | Outperform | $38.00 | $30.00 |

| Carlos De Alba | Morgan Stanley | Raises | Overweight | $34.00 | $23.00 |

| Bill Peterson | JP Morgan | Lowers | Neutral | $18.00 | $21.00 |

| Bill Peterson | JP Morgan | Lowers | Neutral | $21.00 | $22.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to MP Materials. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of MP Materials compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for MP Materials's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into MP Materials's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on MP Materials analyst ratings.

Discovering MP Materials: A Closer Look

MP Materials Corp is the producer of rare earth materials in the Western Hemisphere. The company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. The company is also developing a rare earth metal, alloy, and magnet manufacturing facility in Fort Worth, Texas. The company's operations are organized into two reportable segments: Materials and Magnetics.

Key Indicators: MP Materials's Financial Health

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining MP Materials's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 24.91% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: MP Materials's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -37.24%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): MP Materials's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.17% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): MP Materials's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.96% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: MP Materials's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.88, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Benchmark | Upgrades | Hold | Buy |

| Dec 2021 | Morgan Stanley | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings