What 14 Analyst Ratings Have To Say About Dynatrace

Providing a diverse range of perspectives from bullish to bearish, 14 analysts have published ratings on Dynatrace (NYSE:DT) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 5 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 5 | 4 | 3 | 0 | 0 |

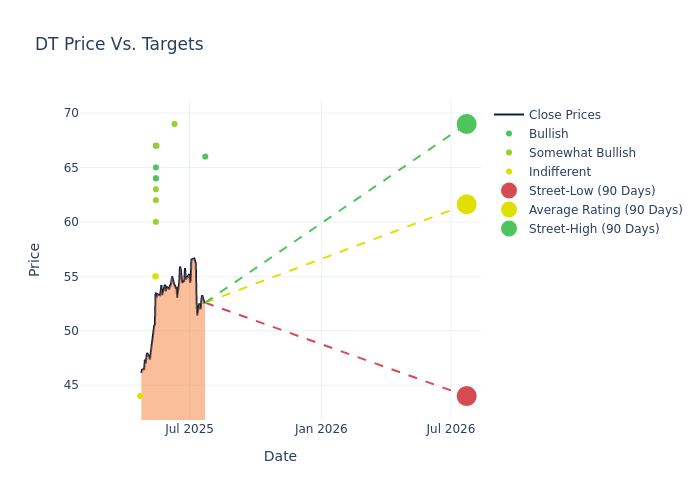

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $62.43, along with a high estimate of $69.00 and a low estimate of $50.00. Marking an increase of 5.37%, the current average surpasses the previous average price target of $59.25.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Dynatrace is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Howard Ma | Guggenheim | Announces | Buy | $66.00 | - |

| Eric Heath | Keybanc | Announces | Overweight | $69.00 | - |

| Taz Koujalgi | Wedbush | Maintains | Outperform | $67.00 | $67.00 |

| Kash Rangan | Goldman Sachs | Raises | Buy | $64.00 | $56.00 |

| Matthew Hedberg | RBC Capital | Raises | Outperform | $60.00 | $55.00 |

| Gil Luria | DA Davidson | Raises | Buy | $65.00 | $60.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $67.00 | $67.00 |

| Koji Ikeda | B of A Securities | Raises | Buy | $64.00 | $62.00 |

| Keith Bachman | BMO Capital | Raises | Outperform | $63.00 | $60.00 |

| Karl Keirstead | UBS | Raises | Neutral | $55.00 | $50.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $62.00 | $55.00 |

| Sanjit Singh | Morgan Stanley | Raises | Equal-Weight | $55.00 | $50.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $67.00 | $67.00 |

| Karl Keirstead | UBS | Lowers | Neutral | $50.00 | $62.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dynatrace. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Dynatrace compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Dynatrace's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Dynatrace's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Dynatrace analyst ratings.

About Dynatrace

Dynatrace is a cloud-native company that focuses on analyzing machine data. Its product portfolio, delivered as software as a service, allows a client to monitor and analyze its entire IT infrastructure. Dynatrace's platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to use it for a variety of applications throughout their businesses.

Key Indicators: Dynatrace's Financial Health

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Dynatrace's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 16.89%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Dynatrace's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.83%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Dynatrace's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.52%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Dynatrace's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.0%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.03, Dynatrace adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for DT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Rosenblatt | Maintains | Buy | |

| Feb 2022 | BTIG | Downgrades | Buy | Neutral |

| Feb 2022 | Needham | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings