4 Analysts Assess Mr. Cooper Gr: What You Need To Know

Across the recent three months, 4 analysts have shared their insights on Mr. Cooper Gr (NASDAQ:COOP), expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

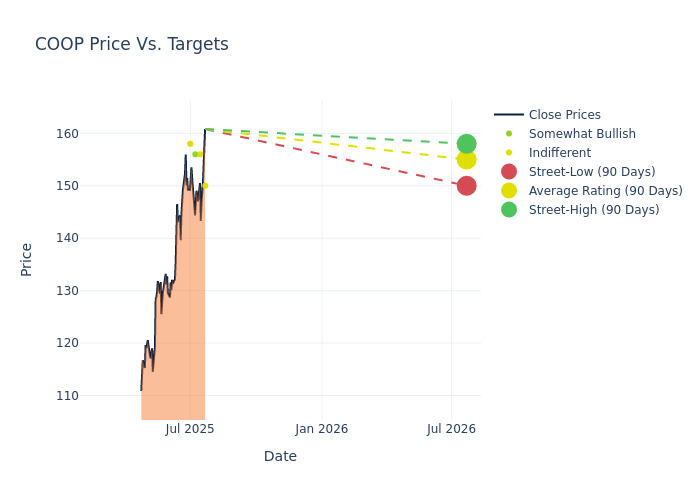

In the assessment of 12-month price targets, analysts unveil insights for Mr. Cooper Gr, presenting an average target of $155.0, a high estimate of $158.00, and a low estimate of $150.00. This current average has increased by 16.25% from the previous average price target of $133.33.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Mr. Cooper Gr among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matthew Hurwit | Jefferies | Raises | Hold | $150.00 | $110.00 |

| Douglas Harter | UBS | Announces | Neutral | $156.00 | - |

| Terry Ma | Barclays | Raises | Overweight | $156.00 | $147.00 |

| Crispin Love | Piper Sandler | Raises | Neutral | $158.00 | $143.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Mr. Cooper Gr. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Mr. Cooper Gr compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Mr. Cooper Gr's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Mr. Cooper Gr's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Mr. Cooper Gr analyst ratings.

Delving into Mr. Cooper Gr's Background

Mr. Cooper Group Inc is a home loan servicer. The company focuses on delivering a variety of servicing and lending products. It has operating segments namely Servicing segment which performs operational activities on behalf of investors or owners of the underlying mortgages and mortgage servicing rights, including collecting and disbursing borrower payments, investor reporting, and customer service, The Originations segment originates residential mortgage loans through a direct-to-consumer channel, which provides refinance options for existing customers, and through a correspondent channel, which purchases or originates loans from mortgage bankers and brokers, and the Corporate segment. The Servicing segment of the company generates maximum revenue.

A Deep Dive into Mr. Cooper Gr's Financials

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Positive Revenue Trend: Examining Mr. Cooper Gr's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.74% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Mr. Cooper Gr's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 11.75%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Mr. Cooper Gr's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.81%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Mr. Cooper Gr's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.47%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Mr. Cooper Gr's debt-to-equity ratio is below the industry average at 2.29, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for COOP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Barclays | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings