Beyond The Numbers: 14 Analysts Discuss Best Buy Co Stock

Best Buy Co (NYSE:BBY) has been analyzed by 14 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 4 | 3 | 6 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

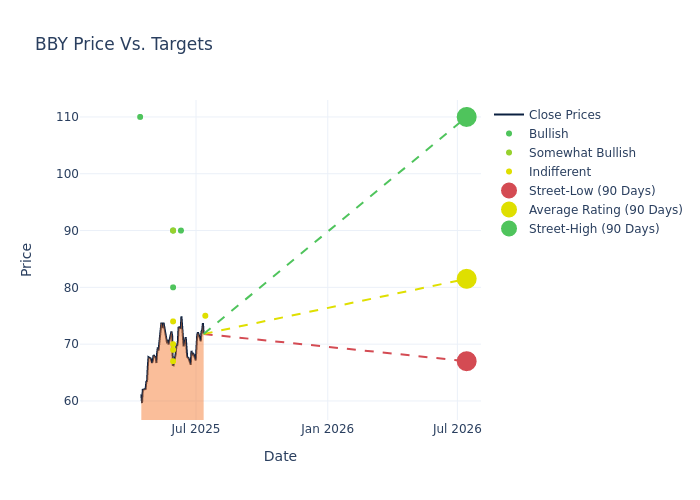

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $79.79, along with a high estimate of $90.00 and a low estimate of $67.00. A 7.13% drop is evident in the current average compared to the previous average price target of $85.92.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Best Buy Co's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Peter Keith | Piper Sandler | Lowers | Neutral | $75.00 | $82.00 |

| Steven Forbes | Guggenheim | Maintains | Buy | $90.00 | $90.00 |

| Anthony Chukumba | Loop Capital | Lowers | Buy | $80.00 | $90.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $69.00 | $64.00 |

| Peter Keith | Piper Sandler | Lowers | Overweight | $82.00 | $92.00 |

| Seth Sigman | Barclays | Lowers | Equal-Weight | $74.00 | $89.00 |

| Michael Lasser | UBS | Lowers | Buy | $90.00 | $95.00 |

| Steven Forbes | Guggenheim | Maintains | Buy | $90.00 | $90.00 |

| Alicia Reese | Wedbush | Lowers | Neutral | $70.00 | $75.00 |

| Zachary Fadem | Wells Fargo | Lowers | Equal-Weight | $67.00 | $75.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $90.00 | $90.00 |

| Alicia Reese | Wedbush | Announces | Neutral | $75.00 | - |

| Joseph Feldman | Telsey Advisory Group | Lowers | Outperform | $90.00 | $100.00 |

| Zachary Fadem | Wells Fargo | Lowers | Equal-Weight | $75.00 | $85.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Best Buy Co. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Best Buy Co compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Best Buy Co's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Best Buy Co's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Best Buy Co analyst ratings.

Unveiling the Story Behind Best Buy Co

With over $41 billion in consolidated 2024 sales, Best Buy is the largest pure-play consumer electronics retailer in the US, boasting roughly 8% share of the North American market and around 33% share of offline sales in the region, per our calculations, CTA, and Euromonitor data. The firm generates the bulk of its sales in-store, with mobile phones and tablets, computers, and appliances representing its three largest categories. Recent investments in e-commerce fulfillment, accelerated by the covid pandemic, have seen the US e-commerce channel roughly double from prepandemic levels, with management estimating that it will represent a mid-30% proportion of sales moving forward.

Financial Insights: Best Buy Co

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Decline in Revenue: Over the 3M period, Best Buy Co faced challenges, resulting in a decline of approximately -0.9% in revenue growth as of 30 April, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 2.3%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.25%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Best Buy Co's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.4% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a high debt-to-equity ratio of 1.47, Best Buy Co faces challenges in effectively managing its debt levels, indicating potential financial strain.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BBY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Truist Securities | Maintains | Hold | |

| Mar 2022 | Jefferies | Maintains | Buy | |

| Mar 2022 | Guggenheim | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings