The Analyst Verdict: Fortinet In The Eyes Of 15 Experts

During the last three months, 15 analysts shared their evaluations of Fortinet (NASDAQ:FTNT), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 10 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 8 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

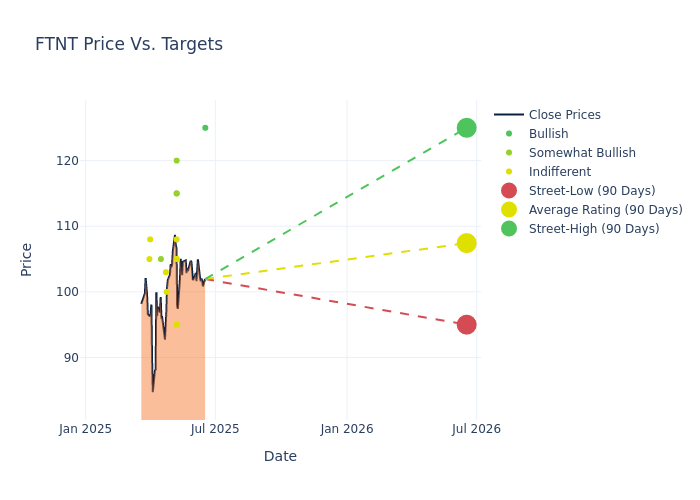

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $107.8, along with a high estimate of $125.00 and a low estimate of $95.00. Observing a downward trend, the current average is 8.47% lower than the prior average price target of $117.77.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Fortinet is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Catharine Trebnick | Rosenblatt | Maintains | Buy | $125.00 | $125.00 |

| Daniel Ives | Wedbush | Lowers | Outperform | $120.00 | $130.00 |

| Roger Boyd | UBS | Lowers | Neutral | $105.00 | $115.00 |

| Dan Bergstrom | RBC Capital | Lowers | Sector Perform | $105.00 | $110.00 |

| Eric Heath | Keybanc | Lowers | Overweight | $115.00 | $120.00 |

| Patrick Colville | Scotiabank | Lowers | Sector Outperform | $115.00 | $135.00 |

| Andrew Nowinski | Wells Fargo | Lowers | Equal-Weight | $95.00 | $105.00 |

| Adam Borg | Stifel | Lowers | Hold | $95.00 | $115.00 |

| Shrenik Kothari | Baird | Lowers | Neutral | $108.00 | $113.00 |

| Shrenik Kothari | Baird | Raises | Neutral | $113.00 | $110.00 |

| Jonathan Ruykhaver | Cantor Fitzgerald | Lowers | Neutral | $100.00 | $115.00 |

| Taz Koujalgi | Roth Capital | Announces | Neutral | $103.00 | - |

| Hamza Fodderwala | Morgan Stanley | Lowers | Overweight | $105.00 | $123.00 |

| Todd Weller | Stephens & Co. | Announces | Equal-Weight | $108.00 | - |

| Joseph Gallo | Jefferies | Lowers | Hold | $105.00 | $115.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Fortinet. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Fortinet compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Fortinet's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Fortinet's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Fortinet analyst ratings.

Discovering Fortinet: A Closer Look

Fortinet is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, zero-trust access, and security operations. The firm derives a majority of its revenue through sales of its subscriptions and support-based business. The California-based firm has more than 800,000 customers across the world.

Financial Insights: Fortinet

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Fortinet's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 13.77% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: Fortinet's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 28.15% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Fortinet's ROE excels beyond industry benchmarks, reaching 25.08%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Fortinet's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.3% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Fortinet's debt-to-equity ratio is below the industry average at 0.51, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FTNT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Wedbush | Maintains | Outperform | |

| Feb 2022 | Wells Fargo | Maintains | Overweight | |

| Feb 2022 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings