Bill Ackman Loaded Up On Nike, Now This Analyst Says Stock Expected To Shoot Up 32% By 2027 Thanks To These Factors

Despite facing near-term headwinds, Nike Inc.’s (NYSE:NKE) turnaround strategy with the new CEO at the helm can propel the stock by 32% to $97 per share, said an analyst as veteran hedge fund manager Bill Ackman loads up on the shares.

What Happened: Daan Rjinberk, a senior officer of trade services at Rabobank in his latest note on Nike dated Dec. 28 has said that the sportswear company faces short-term challenges, but management is taking steps to address them.

According to his note, while high growth is unlikely, the company has strong long-term potential driven by margin expansion and a return to positive revenue growth. Rjinberk says that the current valuation is fair, but there is potential for upside if the company successfully executes its turnaround strategy.

Bill Ackman‘s Pershing Square Capital Management increased its stake in Nike by 436% during the third quarter. As per its 13F filing, Nike now represents 11% of Pershing Square’s holdings with a total of 16.280 million shares valued at $1.439 billion.

Being cautiously bullish on Nike, Rjinberk said, “Using a 30x long-term multiple and my current FY27 EPS consensus, which leaves plenty of room for upside, I calculate a May 2027 target price of $97 per share. This translates into potential annual returns (CAGR) of roughly 10% or closer to 12%, including dividends.”

However, he added that he would be more comfortable initiating or adding to positions at lower price levels, such as below $78 per share.

Why It Matters: Nike reported strong Q2 earnings in December end, exceeding both revenue and earnings expectations. However, the company’s new CEO Elliott Hill criticized his predecessor’s strategies, suggesting the company could be performing better.

Hill started at the company as an intern in the 1980s and left Nike in 2020. John Donahoe, was his predecessor before he joined Nike again as its CEO in October.

Talking about straying away from its core principles during its earnings call, Hill said the following was one of his high-level observations.

"We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision." He added that relying on a "handful of sportswear silhouettes is not who we are."

See Also: SoFi Tech Downgraded Over Valuation Concerns: Stock Priced Three Times Its Peers

Guidance: Nike CFO Matthew Friend anticipates a challenging near-term outlook, with a double-digit revenue decline and a 300-350 basis point gross margin contraction. Increased marketing expenses and greater headwinds in the fourth quarter are also expected.

Price Action: Nike stock closed Thursday 2.64% lower at $73.67 and rose by 0.31% to $73.90 in after-hours. It has declined by 30.86% in 2024, as per Benzinga Pro. The shares have fallen by 6.58% over the last month and by 2.09% over the last six months.

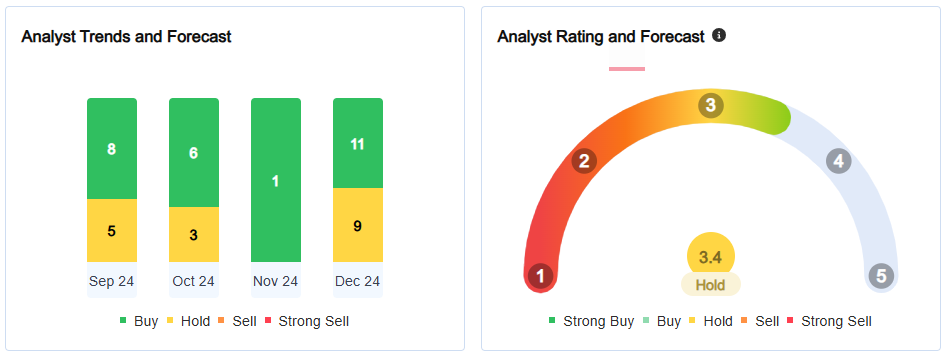

About 31 analysts tracked by Benzinga have a consensus ‘hold’ rating on the stock with a consensus price target of $91.45. The three most recent analyst ratings between UBS, Baird, and Stifel with an average price of $84.33 imply a 14.12% upside for Nike.

Read Next:

Photo courtesy: Shutterstock

Latest Ratings for NKE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Cowen & Co. | Maintains | Outperform | |

| Jan 2022 | Wells Fargo | Upgrades | Equal-Weight | Overweight |

| Jan 2022 | Seaport Global | Initiates Coverage On | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bill AckmanAnalyst Color Equities Market Summary News Price Target Markets Analyst Ratings