Tesla Analyst Asks 'Do Earnings Matter?' Ahead Of Q2 Report: Robotaxis, China, EV Guidance In Focus

Ahead of second-quarter financial results, a Tesla Inc (NASDAQ:TSLA) analyst says investors aren't focused on earnings, but rather what comes next after Tuesday's report.

The Tesla Analyst: Guggenheim analyst Ronald Jewsikow reiterated a Sell rating on Tesla and $134 price target.

The Analyst Takeaways: Investors will be focused on what comes next for Tesla and not the past earnings, Jewsikow said.

The analyst said Tesla delaying the robotaxi event from Aug. 8 will be top of mind for investors.

"With the planned 8/8 event now formally delayed, investors will look for color on the new timeline, what to expect at the event and more details on the delay," Jewsikow said.

The delay in the Robotaxi event has led to investors seeing the segment as less actionable, according to the report.

The analyst said 2024 volume guidance could also be a key item to watch in the earnings report.

"We don't believe guiding for y/y volume growth is realistic, but we do not see CEO Elon Musk indicating negative volume growth as his forecast."

China and market share in the country could also be a key focus in the earnings report, the analyst said.

"How does TSLA return to growth with so much competitively priced product in China?"

The analyst expects Tesla to beat earnings per share estimates and miss on automotive gross margins (ex-credits) due to "large discounting actions."

Jewsikow currently ascribes no value to robotaxis, robots, artificial intelligence or insurance when forecasting a price target on Tesla.

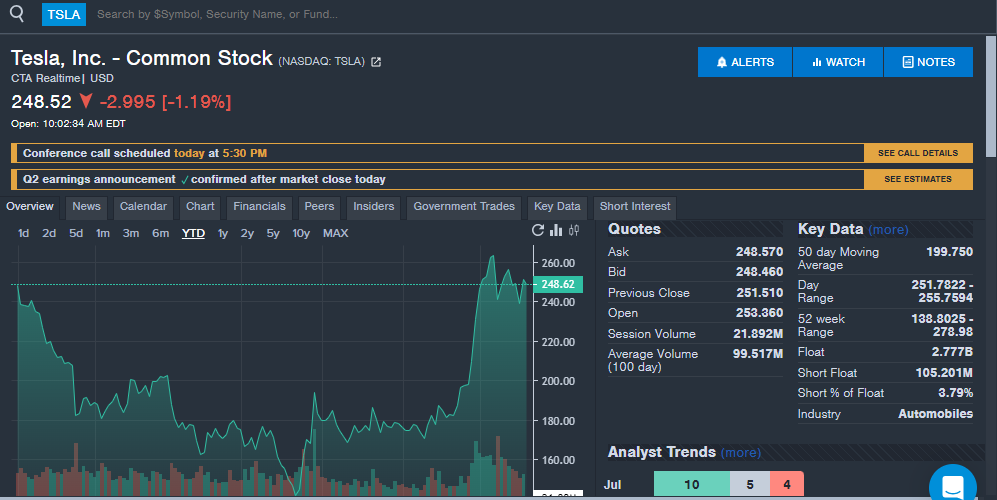

TSLA Price Action: Tesla shares are down 1% to $249.25 on Tuesday versus a 52-week trading range of $138.80 to $278.98. Tesla stock is up 0.3% year-to-date in 2024, after gaining over 30% in the past month, as seen on the Benzinga Pro chart below.

Read Next:

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: China electric vehiclesAnalyst Color Price Target Previews Reiteration Top Stories Analyst Ratings