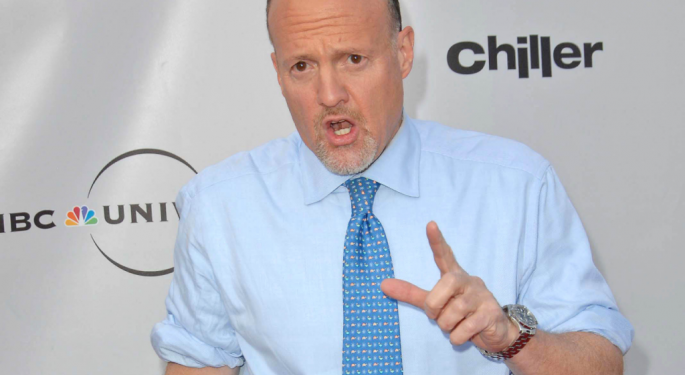

Jim Cramer Tells Investors To 'Wait..For Sell-Off' As Buyers Temporarily Move Away From Magnificent Seven: 'Then Do Some Buying'

CNBC’s Jim Cramer recently shared his market predictions for 2024, suggesting a possible sector rotation and significant influence from Federal Reserve decisions.

What Happened: Cramer on Tuesday predicted that investors might move away from the leading Magnificent Seven tech stocks to invest in sectors that have experienced significant declines, like the food and pharmaceutical industries, reported CNBC.

Cramer stated, “My crystal ball suggests that profits will be taken from the best of the best, including the Magnificent Seven and friends, as well as the richly valued software enterprise names. I think investors will use that cash to invest in companies that haven’t gotten any respect for ages.”

Cramer warned that this shift might be temporary, with investors potentially returning to their December favorites once earnings reports are released.

Cramer believes that the Federal Reserve’s decisions will greatly impact Wall Street activity. He suggests investors should choose stocks from companies with strong leadership and reasonable valuations instead of focusing solely on potential Fed-induced recession fears.

Cramer’s advice to investors is to “wait patiently for the sell-off that I’m expecting and then do some buying.”

Why It Matters: Cramer’s recent advice of waiting for a pullback before investing in overvalued stocks seems to align with his earlier prediction in December. His cautionary stance on tech stocks, such as the case with Cloudflare Inc (NYSE:NET), was clear when he suggested that investors had arrived late to the party.

The renowned Magnificent Seven, a term used to describe a cluster of high-growth tech firms, began 2024 on an unstable footing, witnessing a collective market cap decline of $250 billion during the initial trading session of the year. Shares of Apple Inc. AAPL experienced the sharpest sell-off — over 4%. The other six tech titans — Microsoft Corp. (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon Inc. (NASDAQ:AMZN), Meta Platforms Inc. (NASDAQ:META), NVIDIA Corp. (NASDAQ:NVDA) and Tesla, Inc. (NASDAQ:TSLA) — also saw their market caps decrease.

Read Next: Bitdeer Technologies Group (NASDAQ:BTDR) Q3 Earnings Highlights: Net Loss Slashed, Gross Profit And Gross Margin Up

Image Via Shutterstock

Engineered by

Benzinga Neuro, Edited by

Kaustubh Bagalkote

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: 2024 outlook KB stock market Stories That MatterAnalyst Color Equities News Markets