Almost Done: BofA, Goldman Sachs Expect Fed Hiking Cycle To End By Midyear Amid Banking Credit Crunch

Bank of America (NYSE: BAC) and Goldman Sachs (NYSE: GS) economists say the Fed will reach the end of its rate-hiking cycle in the coming months, as stricter lending standards by commercial banks will diminish pressure for policy rate rises.

In a note published late Wednesday, BofA’s Michael Gapen and Michael Cabana no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5%-5.25% to be hit in May.

“The US economy may see tighter lending standards” that could “substitute for further rate hikes”, according to BofA.

However, “should the stresses in the financial system be reduced in short order, we cannot rule out that stronger macro data will lead the Fed to put in additional rate hikes beyond May,” the BofA analysts added.

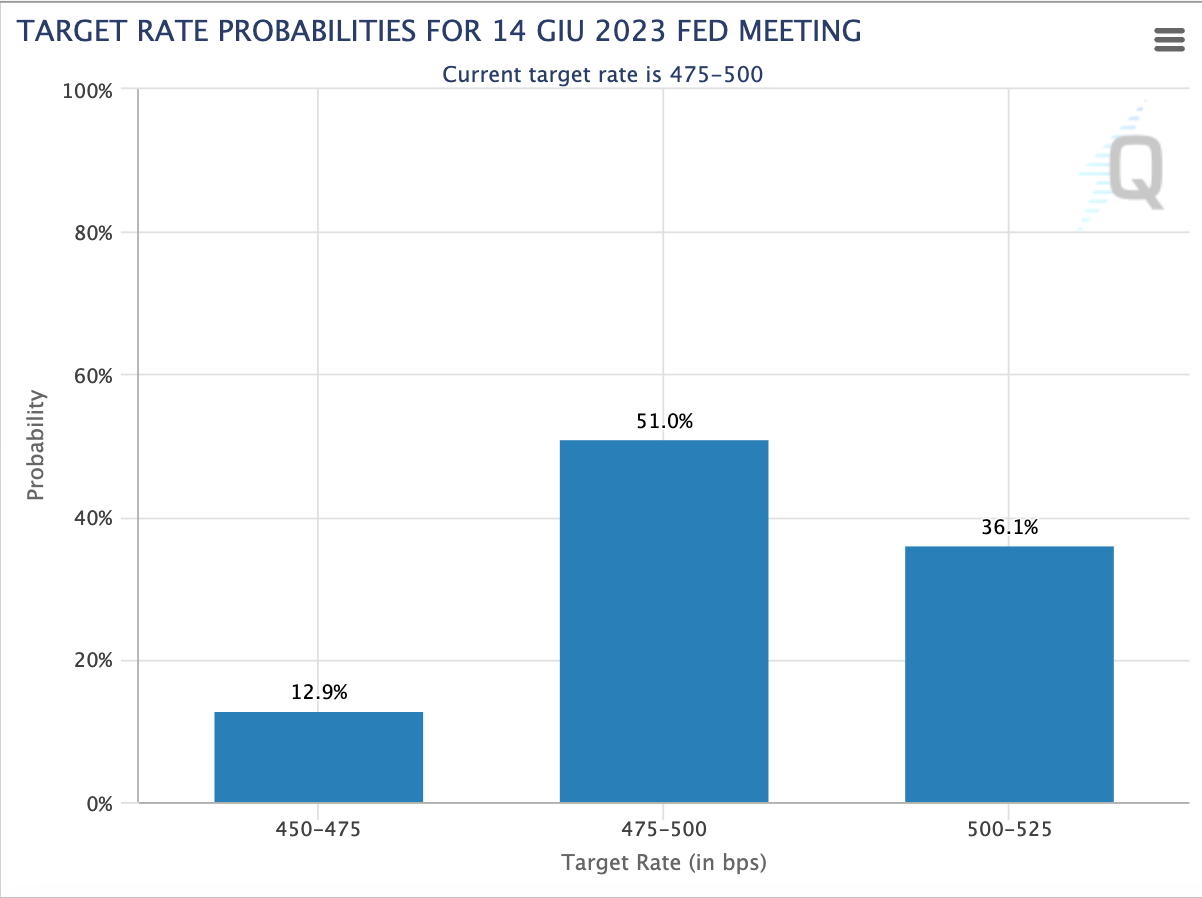

Goldman Sachs’ David Mericle, instead, kept his terminal-rate expectations unchanged at 5.25%-5.5%, thus forecasting additional 25bp rate hikes in May and June.

“It is not clear that large banks will tighten lending standards”, the economist said in the note. However, “we could now envision a combination of a substantial decline in inflation and a desire to relieve the pressure on banks potentially adding up to a reason to lower the funds rate,” he added.

An Update on Market Fed Rate Expectations

The iShares 1-3 Year Treasury Bond ETF (NASDAQ: SHY) soared 0.5% on Wednesday, as traders trimmed rate hike expectations after the FOMC meeting.

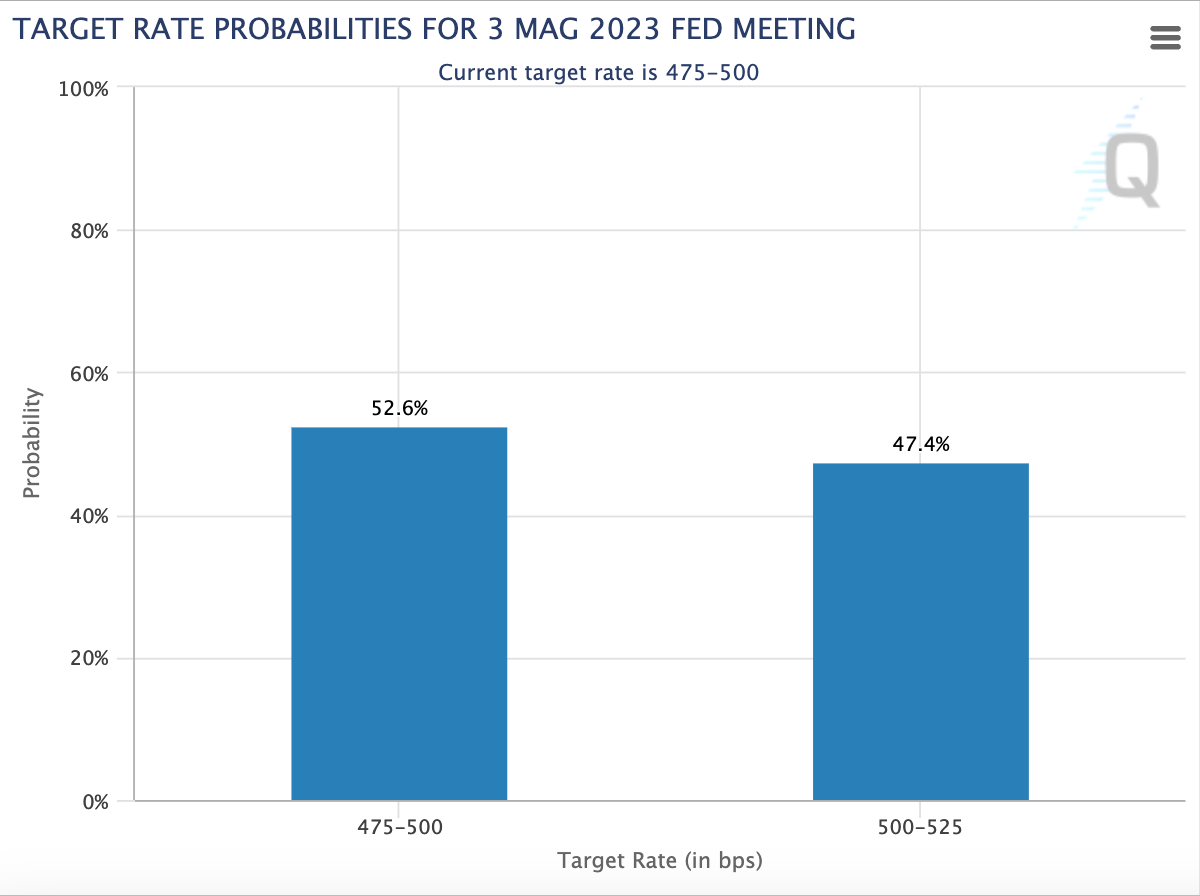

According to CME Group Fed Watch, Fed futures assign a roughly 50-50 likelihood of a hold/hike in May, but only a 37% chance of rates reaching 5-5.25% in June 2023. Therefore, Goldman Sachs' June forecast of a terminal rate of 5.25%-5.5% is rather hawkish and out of consensus.

Read next: Everyone Wishes For Silver And Gold After Fed Meeting: Bitcoin, Stocks Tumble

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bank of AmericaAnalyst Color Top Stories Economics Federal Reserve Markets Analyst Ratings ETFs Best of Benzinga