Tesla Sales Drop 21% In California Ahead Of Q2 Earnings — Market Share Slips Even As Model Y, Model 3 Remain Top EVs

Tesla Inc.'s (NASDAQ:TSLA) sales woes continue as the electric vehicle giant recorded a 21% year-over-year decline in sales in the state of California.

Check out the current price of TSLA stock here.

What Happened: The data, released by the California New Car Dealers Association, or CNCDA, on Tuesday, showcased that the automaker recorded over 41,138 new registrations in the second quarter, a 21.1% decline from the previous year's figure of 52,119 registrations.

Tesla's year-to-date sales through June fell 18.3% compared to the same period in 2024, with registrations dropping to 83,375 from 101,991. The decline also pushed Tesla's market share down to 45.3% from 53.4% a year earlier — an 8.1% slide.

Tesla's second-quarter market share stands at 8.5%, down 2.9% from last year's 11.4% in California. However, the Model Y and the Model 3 continued to be top-selling EVs in the state, with 44,112 units and 31,394 units sold in the state, respectively.

Why It Matters: The news comes in as Tesla is readying itself for the company's second quarter earnings call scheduled to take place on Wednesday after market close. Analysts expect the company to report a second-quarter revenue of $22.79 billion.

Bank Of America also raised Tesla's price target to $341 ahead of the earnings call, citing confidence from the Robotaxi launch in Austin, which could help the company deliver on the Unsupervised FSD promise by the end of the year.

Piper Sandler analyst Alex Potter also reiterated the $500 price target for the company, saying that President Donald Trump's ZEV regulations wouldn't affect the company as adversely as feared.

Elsewhere, Tesla finally opened the doors to its diner in LA, with the company's Supercharger cum Drive-In Theater cum Diner best described as Hitchhiker’s Galaxy meets Buc-ee’s meets EV charging.

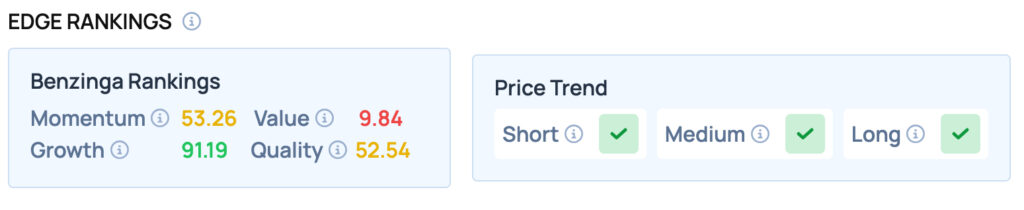

Tesla offers Satisfactory Momentum and Quality, while scoring well on the Growth metric, but offering poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo Courtesy: Around the World Photos On Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News