Tesla Will Further Dominate EV Market In 2023, Says Analyst — Why He Is Slashing Price Target By 24%

Tesla Inc.’s (NASDAQ: TSLA) stock price received another price target cut, underlining tempered expectations concerning the stock and the company.

The Tesla Analyst: Morgan Stanley analyst Adam Jonas reiterated an Overweight rating on Tesla stock and reduced the price target from $330 to $250. The bull- and bear-case targets were also taken down from $500 and $150, respectively, to $440 and $80.

See Also: Best Electric Vehicle Stocks

This was a sort of back-to-back downward adjustment, as in late October, the analyst lowered the price target from $350.

The Tesla Thesis: Tesla’s 45% sell-off in December is driven by supply outstripping demand for the first time since the COVID-19 pandemic and technical factors, Jonas said.

The analyst sees 2023 as a “reset year” for the electric vehicle market, where the last two years of “demand exceeding supply” will be substantially inverted to “supply exceeding demand.” In such an environment, players that are self-funded with demonstrated scale and cost leadership throughout the value chain can be relative winners, Jonas said.

Tesla may be in a position to extend its lead versus the EV competition, taking into account both legacy automakers and startups, in 2023, even without considering the benefits from the “Inflation Reduction Act,” Jonas said.

All the same, the company is set to face challenges such as a worsening macro backdrop, record-high unaffordability and increasing competition, the analyst said. “Yet we do believe that in the face of all these pressures, TSLA will widen its lead in the EV race, as it leverages its cost and scale advantages to further itself from the competition,” he added.

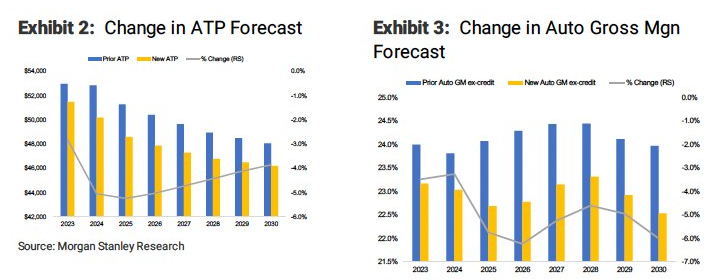

The analyst attributed the price target cut to his lower average transaction price expectation and the risk of autonomous driver assistance system commoditization. He sees an attractive entry for investors as the stock approaches Morgan Stanley’s $80 bear-case target, as well as sub-10 times 2025 EBITDA multiple.

Source: Morgan Stanley

On the China front, Tesla’s Giga Shanghai Model Y production nearly halved from 14,000-16,000 per week in late November to 8,000 per week in the previous week, Jonas said, citing data from the firm’s China team. The China news flow has the potential to get worse before it gets better, he added.

Morgan Stanley expects Tesla’s global fourth-quarter deliveries to come in at 399,000 units compared to the consensus estimate of 429,000 units.

Price Action: Tesla closed Wednesday’s session 3.31% higher, at $112.71, according to Benzinga Pro data.

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Adam JonasAnalyst Color News Price Target Reiteration Analyst Ratings Tech Trading Ideas