Look To Semiconductors If You Really Want To Understand U.S. GDP

Investors concerned that the U.S. economy may fall into recession in the near future may be missing a very simple and highly-correlated leading indicator of U.S. GDP growth: semiconductor billings.

According to Andrew Zatlin of Moneyball Economics, the U.S. semiconductor business has been an excellent bellwether for the U.S. economy ever since the bursting of the Dot Com Bubble.

“Semiconductors are the lifeblood of the modern economy,” Zatlin writes. “If a semiconductor isn’t in it, it is in the machine that made it.”

Related Link: Fallout From The Disastrous Doha Oil Producers Meeting: Is The Rally Over?

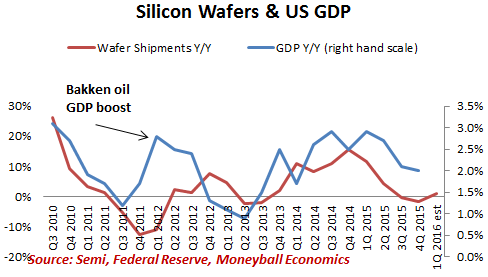

He points out that the shale oil boom is the only time that U.S. semiconductor billings and U.S. GDP growth significantly diverged since 2001.

According to Zatlin, there are several advantages to using the semiconductor business as a signal for GDP. Semiconductor demand is a leading indicator, it provides strong visibility to end-user demand and the business has a fixed production cycle.

What is this correlation saying about U.S. GDP growth in the most recent quarter? According to Zatlin, silicon wafer shipments suggest that GDP will likely come in between 1.9 and 2.3 percent higher year-over-year.

So far this year, the SPDR S&P 500 ETF Trust (NYSE: SPY) is up 2.1 percent and the Market Vectors Semiconductor ETF (NYSE: SMH) is up 3.0 percent.

Disclosure: the author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Andrew Zatlin Moneyball EconomicsAnalyst Color Specialty ETFs Economics Analyst Ratings ETFs Best of Benzinga