Fearful Of Banks, Stifel Notes 'Explosive' Credit Default Swaps Reminiscent Of 2007 And 2011

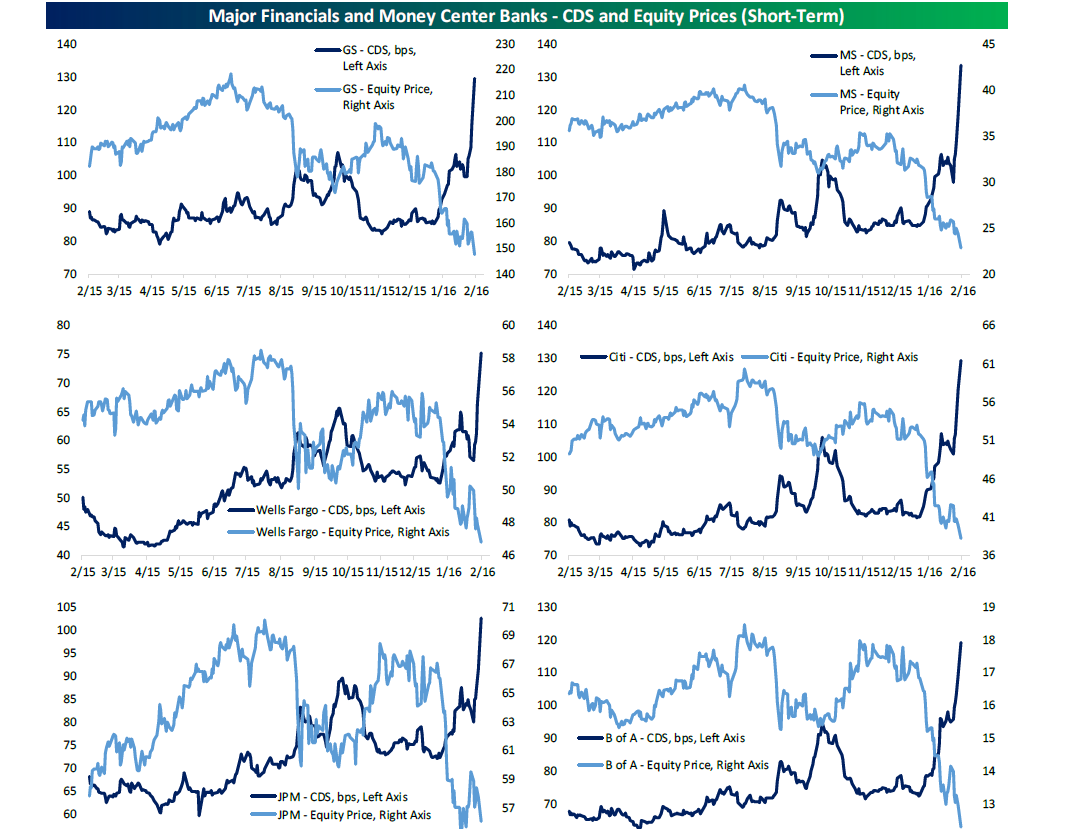

In a new report, Stifel analyst Mark Murphy discusses the growing pessimism in the five-year credit default swap (CDS) market for U.S. megabanks Goldman Sachs Group Inc (NYSE: GS), Morgan Stanley (NYSE: MS), Wells Fargo & Co (NYSE: WFC), Citigroup Inc (NYSE: C), JPMorgan Chase & Co. (NYSE: JPM) and Bank of America Corp (NYSE: BAC).

According to Murphy, the current CDS market spike is reminiscent of spikes in 2007 and 2011.

CDSs are essentially insurance for bondholders; a pickup in CDS levels indicates that investors are becoming worried about the safety of their investments.

Image above from BeSpoke Investing.

“Spreads have gone nearly vertical in the last few days especially, rising at a rate that might be considered crisis-like for its similarity to moves experienced in 2011 or the start of the credit crisis back in 2007,” Murphy explains.

Related Link: 'Credit Default Swap' Data Indicate Increasing Short-Term Market Risk

Murphy’s concerns come just days after BMO Capital Markets analyst Mark Steele penned similar concerns, although Steele noted that CDS levels for European banks such as Deutsche Bank AG (USA) (NYSE: DB) and Credit Suisse Group AG (ADR) (NYSE: CS) are currently much higher than those of any of their American counterparts.

Despite market fears of a major downturn, Murphy noted that the current extremes in short-term fear indicators means that the probability of a market rebound remains high.

Disclosure: the author owns shares of Bank of America.

Latest Ratings for BAC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Baird | Upgrades | Underperform | Neutral |

| Jan 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | JP Morgan | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color News Short Ideas Top Stories Economics Markets Analyst Ratings Trading Ideas Best of Benzinga