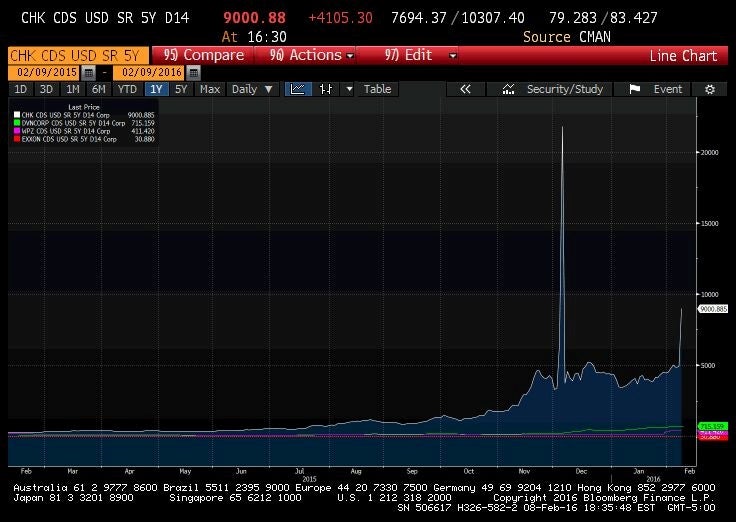

Chesapeake Energy's Default Risk Just Spiked

A huge spike in the Chesapeake Energy Corporation (NYSE: CHK) insurance on senior five-year bond default cost index this week indicates that investors are growing increasingly pessimistic about the company’s ability to avoid default.

Shares of the company’s common stock fell 33 percent to open the week after reports surfaced that the company is now working with restructuring attorneys Kirkland & Ellis.

A mid-day press release from Chesapeake assured investors that the company has been working with the firm since 2010, but the reassurance did little to calm market fears.

The spike in the five-year bond default index is the largest since Chesapeake asked bond holders to accept longer-dated debt instruments back in early December.

“The CHK senior unsecured paper was down 7 to 14 points,” Marty Fridson, CIO at Lehmann Livian Fridson Advisors LLC, told Benzinga. “The second lien bond fell ¼ point to 40. With the other paper largely in the teens, the market is putting a very high likelihood of default.”

Other Names To Watch

Fridson also noted that Chesapeake wasn’t the only company that witnessed a spike in default fears this week.

He adds that WPX Energy Inc (NYSE: WPX), Oasis Petroleum Inc. (NYSE: OAS), Halcon Resources Corp (NYSE: HK) and Denbury Resources Inc. (NYSE: DNR) bonds are among the hardest hit so far this week.

Disclosure: The author holds no position in the stocks mentioned.

Latest Ratings for CHK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Feb 2022 | JP Morgan | Initiates Coverage On | Overweight | |

| Jan 2022 | B of A Securities | Initiates Coverage On | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas News Bonds Rumors Commodities Top Stories Exclusives Best of Benzinga