Ice Age Thesis: Here's Why The S&P Might Fall Below 666

In a new report, Societe Generale analyst Albert Edwards explains why the bumpy start to 2016 for global equity markets could be the beginning of a catastrophic collapse in equity valuations to levels below the ones seen during the worst of the Financial Crisis.

According to Edwards, the devaluation of the renminbi will lead to a prolonged period of global deflation and recession. In addition, the global asset bubble that the U.S. Federal Reserve inflated with its aggressive QE programs is now bursting.

Related Link: George Soros Says We're In A Crisis Like 2008

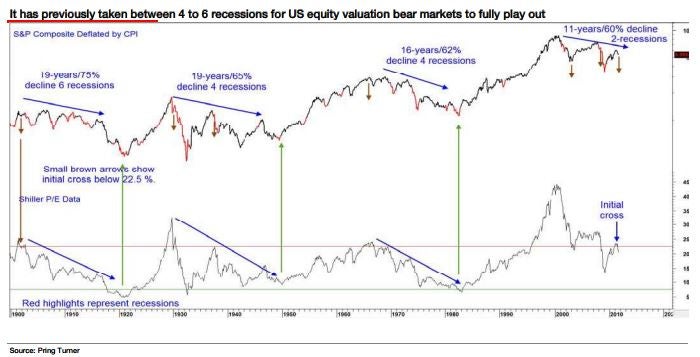

"A key part of my Ice Age thesis is that the US equity market remains in a valuation bear market that did not fully play itself out in March 2009, when the S&P touched the 666 level, and we will see new lows," Edwards predicts.

He expects the S&P to bottom at a Shiller PE of around 7x, implying a 75 percent decline for the index from its 2100 peak down to 550.

Less than two weeks into 2016, the SPDR S&P 500 ETF Trust (NYSE: SPY) is down nearly 6 percent year-to-date.

Disclosure: the author holds no position in the stocks mentioned.

Image Credit: L.C. Nottaasen, Flickr

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Albert Edwards Societe GeneraleAnalyst Color Commodities Top Stories Markets Analyst Ratings ETFs Best of Benzinga