Why The Next Recession Is Coming Sooner Than You Think

A new report by Societe Generale analyst Albert Edwards has the financial world buzzing, and not in a good way.

Edwards argued that the United States is much closer to its next recession than most investors believe. Additionally, the current near-zero interest rate environment has laid the groundwork for a negative Fed funds rate for the first time in history.

The Zero Lower Bound

Most investors operate under the assumption that zero is the lower bound for interest rates and that the current near-zero rates in the United States indicate that the economy is still near the low point in its current cycle.

However, Edwards pointed out that, in reality, while below-zero rates may be unprecedented in the United States, they are certainly not unprecedented globally.

In fact, Sweden currently has a -0.35 percent policy rate in place. Even with interest rates at zero, Sweden had been unable to stimulate any significant inflation since the end of 2012, so it reduced rates to -0.25 percent in early 2015 and further to -0.35 percent this summer.

Edwards believes that Sweden’s measures demonstrate that the zero rate bound is not a true limit on rates. “If -0.35 percent is possible, why not -3.5 percent or less?” he asked in his report.

The Negative Dots

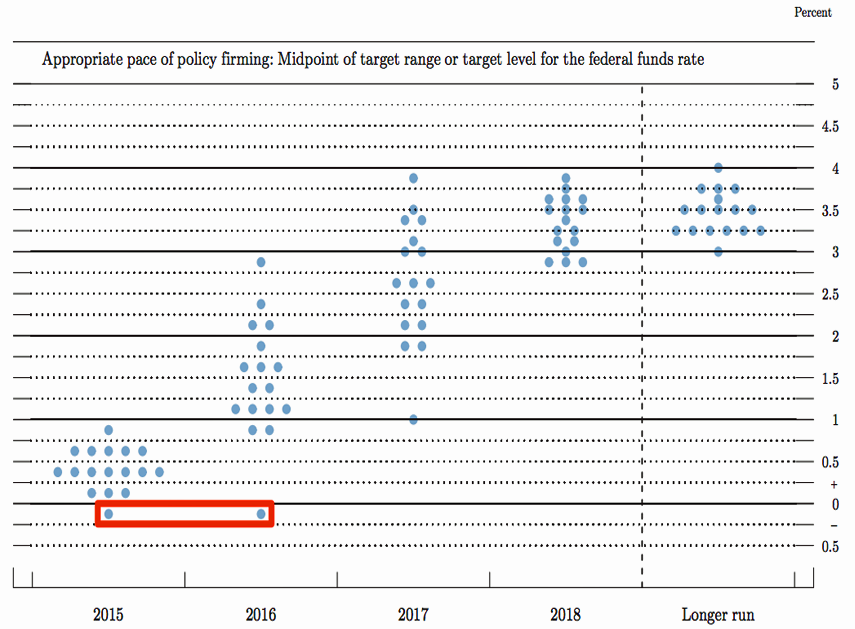

If Edwards’ scenario seems far-fetched, look no further than the Federal Reserve’s latest interest rate dot plot for confirmation of the possibility.

Clearly, the possibility of negative interest rates is a reality for one policymaker.

As if that idea wasn’t scary enough, the day after the dot plot was released, the Bank of England’s chief economist Andrew Haldane discussed the possibility of a ban on cash to eliminate the possibility of hoarding in a negative interest rate environment.

Edwards admitted that even he hadn’t taken the scenario to that much of an extreme, but he does believe it could be messy. “The last seven years of exploding central bank balance sheets will seem like Bundesbank monetary austerity compared to what is to come,” he wrote.

A Lost U.S. Decade?

Japan was unwilling to breach the zero lower bound when it was suffering from deflation during its lost decade, so a potential U.S. journey into negative territory would be the first of its kind for a global economic powerhouse.

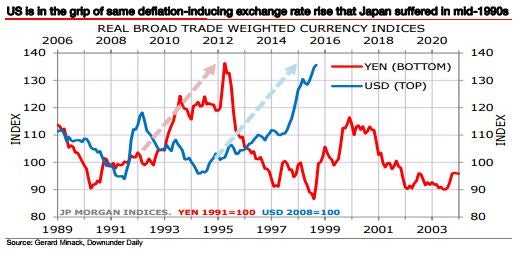

Edwards pointed out that Japan’s lost decade was preceded by a rapid exchange rate rise similar to the one that the United States has recently been experiencing.

However, things could get much worse for the United States than they did for Japan during the 1990s. Despite its internal issues, Japan could rely on exports to other rapidly expanding global economies throughout the lost decade. The United States will not be afforded the same luxury.

The Numbers

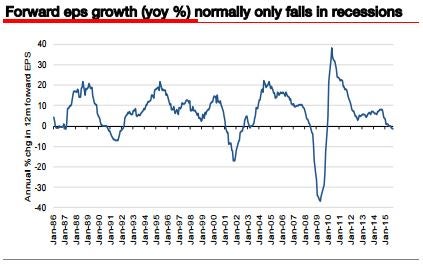

In his report, Edwards presented compelling evidence that a U.S. recession could be imminent. First, he pointed out that forward U.S. earnings growth has been on the decline, a phenomenon that usually precedes a recession.

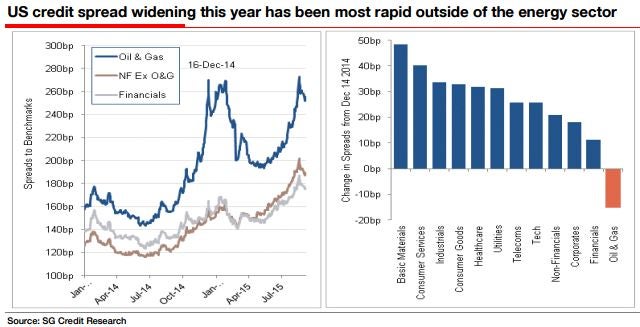

Market bulls argue that these numbers are skewed because of the extreme weakness in the energy sector, but Edwards pointed to rapid credit spread expansion in other sectors as well.

“Rising spreads are not just contained in the energy sector like they weren’t just contained in sub-prime,” he explained, drawing comparisons to the U.S. housing bubble.

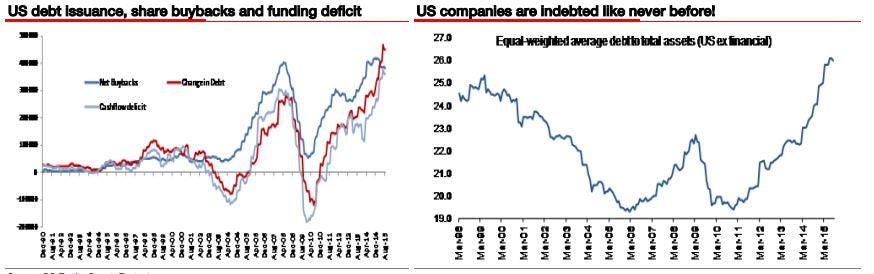

U.S. corporate debt levels have never been higher, but Edwards highlighted how little of that debt has been spent on business expansion. The majority of that debt has been spent on equity buybacks.

China

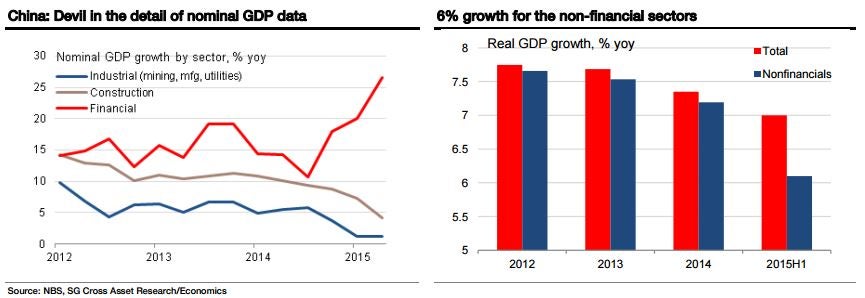

Edwards concluded his discussion with an overview of one of the main global market drivers in recent weeks: China. While China has been reporting 7.0 percent GDP growth throughout the first half of 2015, Edwards pointed out a troubling trend in the type of growth China is experiencing.

GDP growth in China’s financial sector has exploded, while growth in construction has fallen off and growth in the industrial sector has sunk to nearly zero.

Takeaway

Edwards’ contrarian view of U.S. economic health is certainly a troubling one for investors as it paints a very bleak picture of the potential for investment returns in coming years.

If Edwards is correct, not only will there be no FOMC rate hike before the end of 2015, interest rates could soon be breaching the zero lower bound and begin heading into uncharted negative territory.

Image Credit: Public Domain

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Education Emerging Markets Eurozone Economics Federal Reserve Markets Analyst Ratings Best of Benzinga