Top 3 Financial Stocks That May Rocket Higher This Month

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

EZCORP Inc (NASDAQ:EZPW)

- On April 28, EZCORP posted downbeat quarterly sales. Lachie Given, Chief Executive Officer, said, “Our team delivered another impressive quarter of operational and financial performance, highlighted by record Q2 PLO, which drove strong growth in revenue and pawn service charges. Persistent inflation and economic pressure continue to impact value-conscious consumers who are increasingly turning to us for short-term cash and secondhand goods. Our strengthened operating model and best-in-class customer service also fueled the bottom line, driving a material increase in adjusted EBITDA to $45.1 million, up 23%.” The company's stock fell around 18% over the past month and has a 52-week low of $9.66.

- RSI Value: 26.8

- EZPW Price Action: Shares of EZCORP fell 2.2% to close at $13.14 on Thursday.

- Edge Stock Ratings: 87.01 Momentum score with Value at 85.88.

Compass Diversified Holdings (NYSE:CODI)

- On April 1, Compass Diversified reported the appointment of Matthew Blake as CEO of Arnold Magnetics. “On behalf of Compass and Arnold, I want to extend our sincere gratitude to Dan for his dedication and service in building Arnold into the industry leader it is today,” said Elias Sabo, CEO of CODI. “Under his leadership, Arnold has strengthened its position as a leading solutions provider, successfully navigated the COVID-19 pandemic and oversaw the company’s recent plant relocation. We wish him all the best. I also want to welcome Matt to both Arnold and Compass Diversified. With leadership experience spanning multiple facets of industrial manufacturing, I believe he is the ideal choice to lead Arnold in its next phase of growth.” The company's stock fell around 56% over the past month and has a 52-week low of $6.05.

- RSI Value: 22.4

- CODI Price Action: Shares of Compass Diversified gained 1.5% to close at $7.36 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in CODI stock.

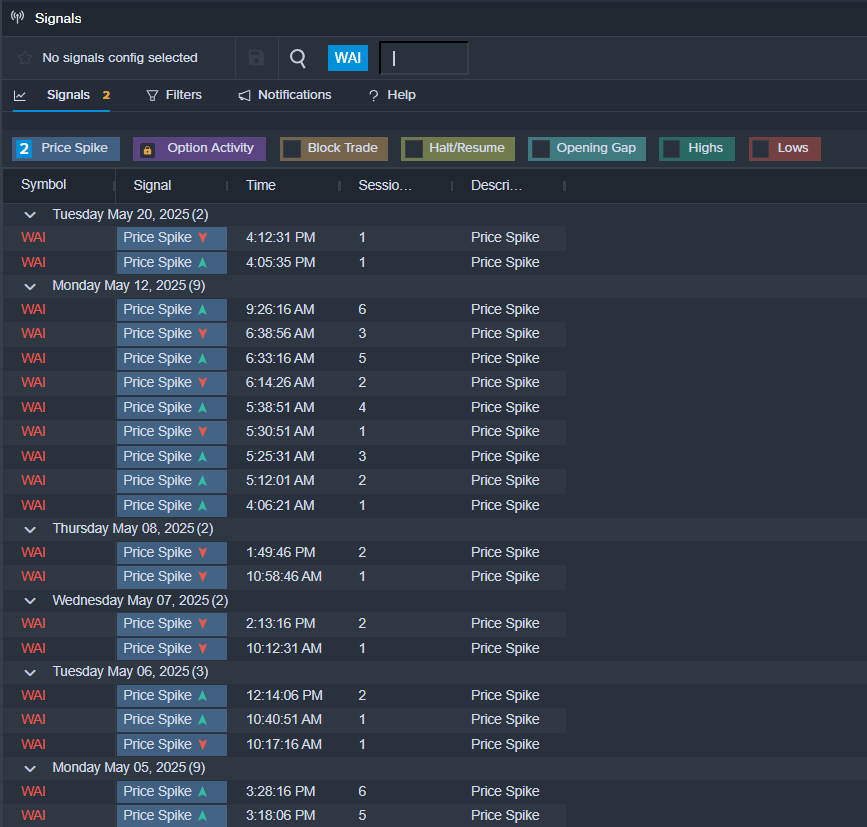

Top KingWin Ltd (NASDAQ:WAI)

- On May 1, Top KingWin announced a 1-for-25 reverse share split. The company's stock fell around 54% over the past month and has a 52-week low of $1.75.

- RSI Value: 28.3

- WAI Ltd Price Action: Shares of Top KingWin fell 5.8% to close at $1.80 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in WAI shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: financial stocks oversold stcoks Pro ProjectLong Ideas News Pre-Market Outlook Markets Trading Ideas