Top 3 Health Care Stocks That May Rocket Higher In April

The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

UnitedHealth Group Inc (NYSE:UNH)

- On April 21, UnitedHealth reported worse-than-expected first-quarter results and cut its FY25 adjusted EPS guidance below estimates. "UnitedHealth Group grew to serve more people more comprehensively but did not perform up to our expectations, and we are aggressively addressing those challenges to position us well for the years ahead, and return to our long-term earnings growth rate target of 13 to 16%," said Andrew Witty, CEO of UnitedHealth. The company's stock fell around 19% over the past month and has a 52-week low of $412.02.

- RSI Value: 27.1

- UNH Price Action: Shares of UnitedHealth fell 1.3% to close at $418.64 on Friday.

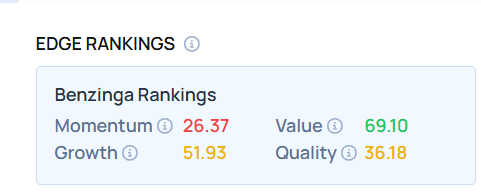

- Edge Stock Ratings: 26.37 Momentum score with Value at 69.10.

Bristol-Myers Squibb Co (NYSE:BMY)

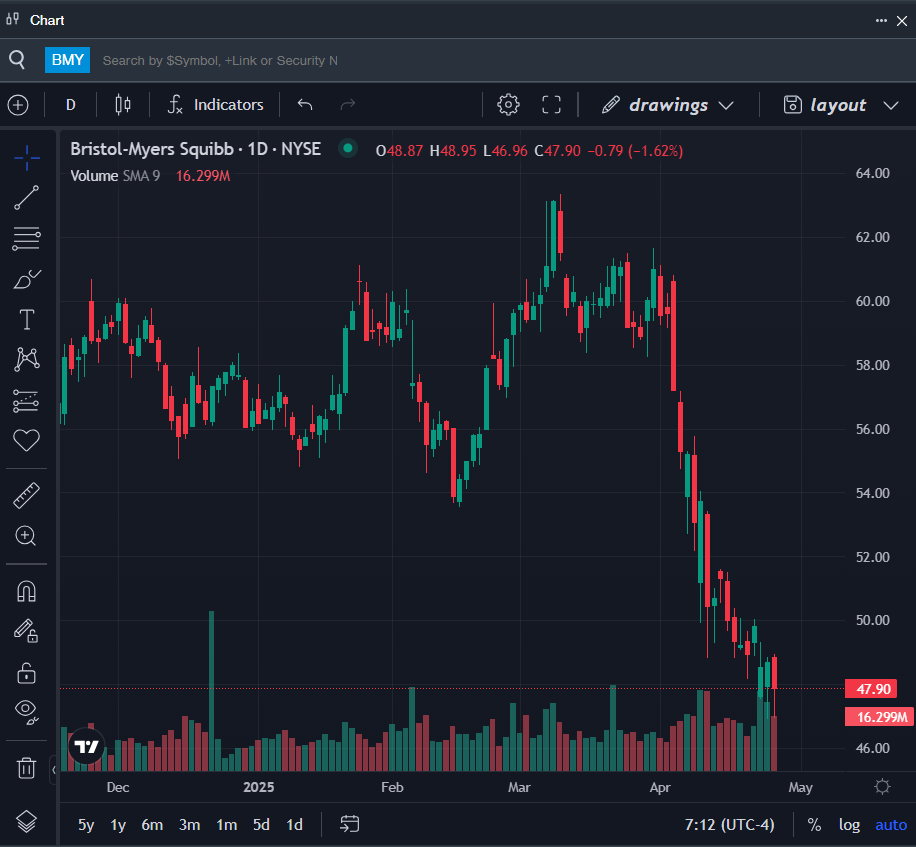

- On April 24, Bristol Myers Squibb reported first-quarter 2025 revenues of $11.20 billion, beating the consensus of $10.70 billion. “Our strong execution in the first quarter drove continued momentum across our Growth Portfolio and meaningful progress in the pipeline,” said Christopher Boerner, Ph.D., board chair and chief executive officer, Bristol Myers Squibb. The company's stock fell around 20% over the past month and has a 52-week low of $39.35.

- RSI Value: 25

- BMY Price Action: Shares of Bristol-Myers Squibb dipped 1.6% to close at $47.90 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in BMY stock.

X4 Pharmaceuticals Inc (NASDAQ:XFOR)

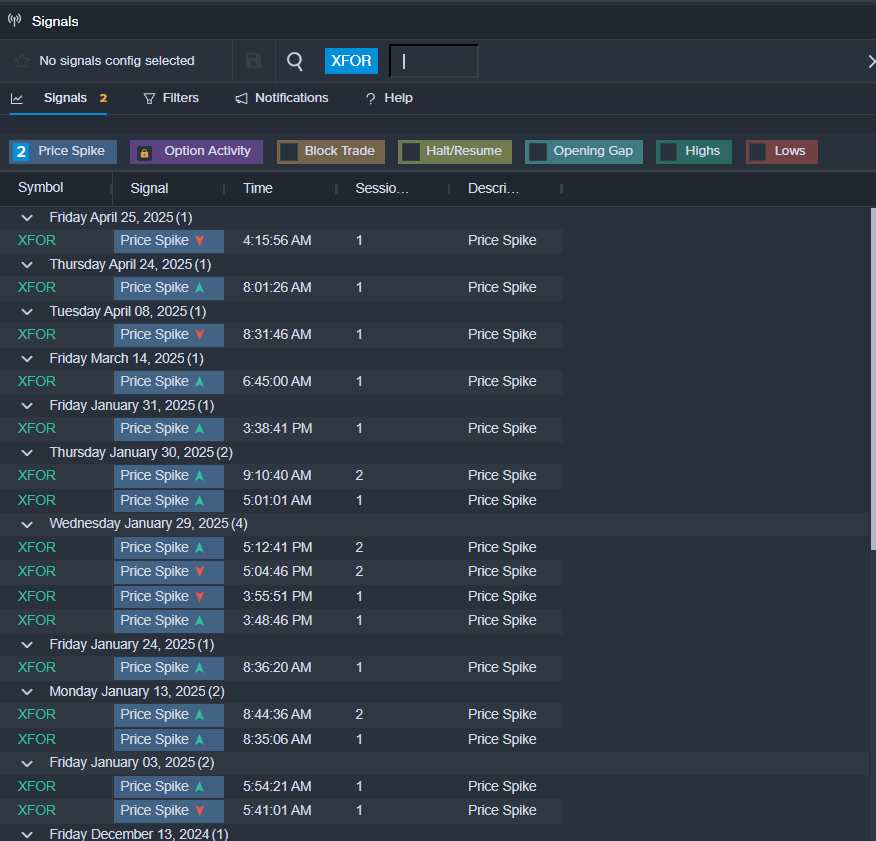

- On April 24, X4 Pharmaceuticals company announced a 1-for-30 reverse stock split. The company has a 52-week low of $0.17.

- RSI Value: 14.7

- XFOR Price Action: Shares of X4 Pharmaceuticals closed at $5.70 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in XFOR shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas health care stocks Oversold StocksLong Ideas News Pre-Market Outlook Markets Trading Ideas