UnitedHealth Group Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bearish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 148 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 39 were puts, with a value of $5,784,802, and 109 were calls, valued at $10,958,932.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $640.0 for UnitedHealth Group over the last 3 months.

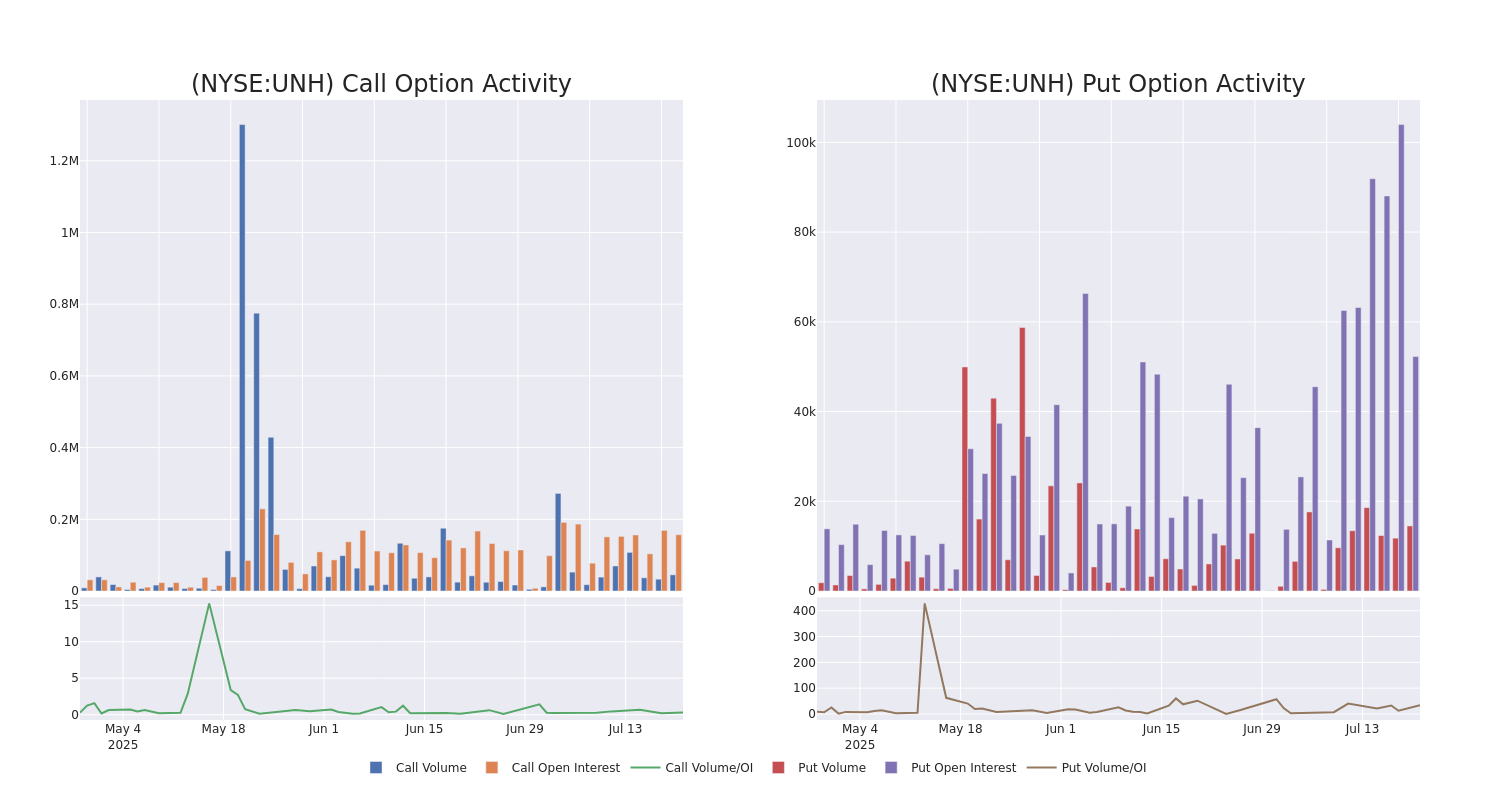

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for UnitedHealth Group's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across UnitedHealth Group's significant trades, within a strike price range of $140.0 to $640.0, over the past month.

UnitedHealth Group Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | PUT | SWEEP | BEARISH | 09/19/25 | $117.5 | $116.95 | $117.4 | $400.00 | $1.0M | 843 | 115 |

| UNH | PUT | TRADE | BULLISH | 03/20/26 | $25.75 | $25.55 | $25.5 | $260.00 | $1.0M | 611 | 407 |

| UNH | PUT | SWEEP | BULLISH | 08/15/25 | $18.25 | $18.2 | $18.2 | $290.00 | $442.5K | 6.1K | 481 |

| UNH | PUT | TRADE | BULLISH | 12/19/25 | $29.6 | $29.4 | $29.45 | $280.00 | $141.3K | 2.0K | 76 |

| UNH | CALL | SWEEP | BEARISH | 01/15/27 | $52.05 | $51.0 | $51.0 | $300.00 | $122.4K | 3.5K | 154 |

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers and provides medical benefits to about 51 million members globally, including 1 million outside the US as of December 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in medical insurance. Along with its insurance assets, UnitedHealth's Optum franchises help create a healthcare services colossus that spans everything from pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

UnitedHealth Group's Current Market Status

- Trading volume stands at 8,704,517, with UNH's price down by -0.46%, positioned at $281.35.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 8 days.

Expert Opinions on UnitedHealth Group

In the last month, 3 experts released ratings on this stock with an average target price of $355.67.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on UnitedHealth Group with a target price of $337.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on UnitedHealth Group with a target price of $345.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for UnitedHealth Group, targeting a price of $385.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for UnitedHealth Group, Benzinga Pro gives you real-time options trades alerts.