Headwinds From Excessive Optimism Mitigated By Improvement In Sector-Level Trends

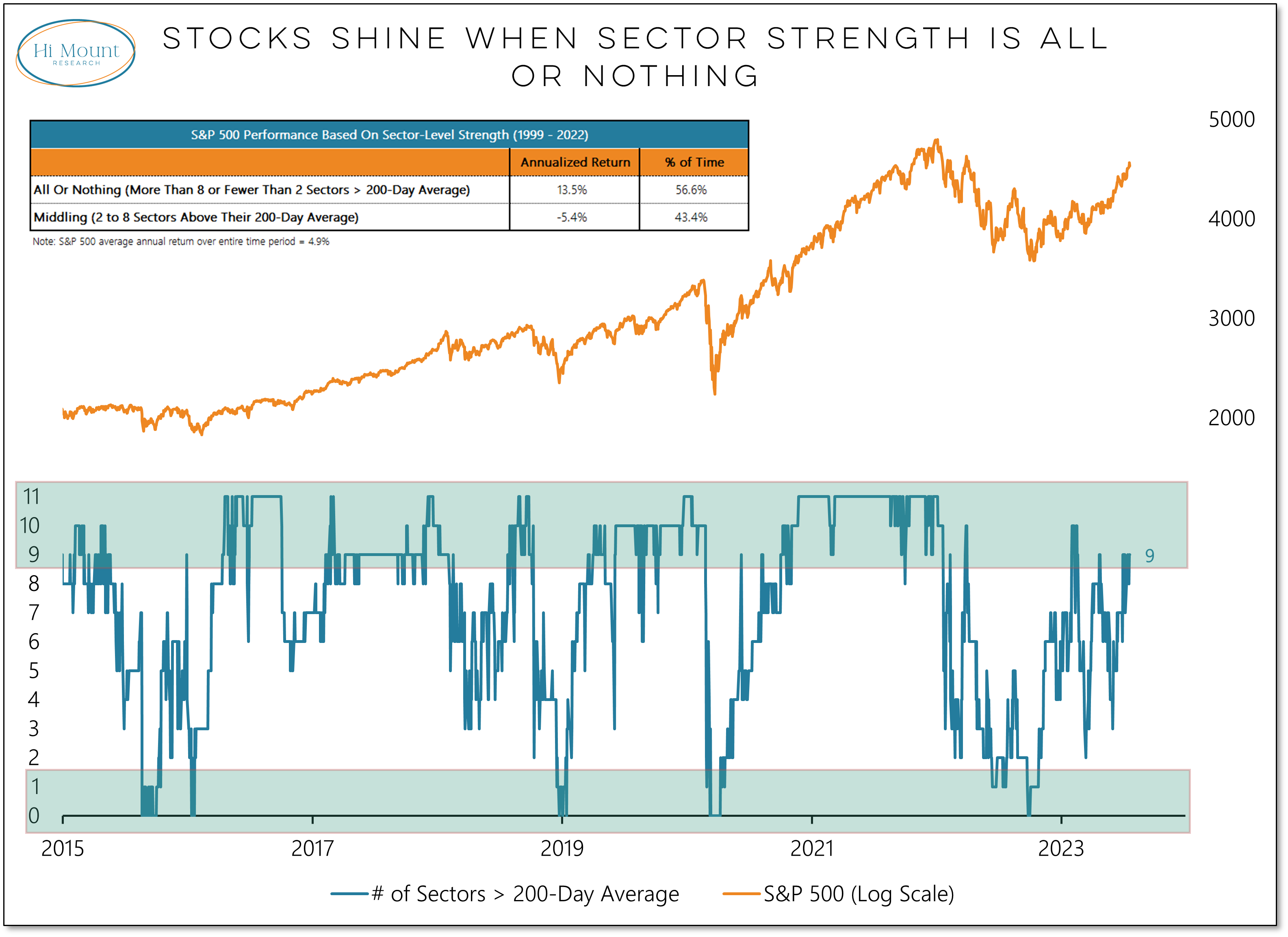

Key Takeaway: Equity call volume is surging but with sector-level trends having improved, the crowd may be justified in looking for higher prices.

More Context: Evidence of excessive optimism continues to emerge as AAII bears drop to their lowest level since Jun 2021 and bulls climb above 50% for the first time since Apr 2021. Periods of speculation and investor fervor have ended in tears in the past. But this is usually not until after breadth has faded and underlying strength has dissipated. When we look at sector level trends right now, the increase in investor optimism has been accompanied by increasingly broad strength.

At the end of May, just 3 of 11 S&P 500 sectors were above their 200-day average. Coming into this week, it had climbed to 9 and this week could end with just one sector (Energy) still below its 200-day average. The chart above only goes back to 2015, but the data over the past quarter century show a clear theme. All the net gains in the S&P 500 have come when sector strength has been either exceptionally good (nine or more sectors are above their 200-day average) or exceptionally bad (no more than one sector is above its 200-day average).

This model is the sector-level corollary to our overall Fear or Strength model, which is positive in the face of either strength (new highs > new lows) or fear (VIX > 28.5). Concerns about speculative excesses are mitigated as long as the market continues to produce strength.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors Energy Sector Expert Ideas S&P 500Markets General