Decoding Carvana's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bearish approach towards Carvana (NYSE:CVNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Carvana. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 20% leaning bullish and 60% bearish. Among these notable options, 5 are puts, totaling $3,113,834, and 5 are calls, amounting to $5,576,850.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $430.0 for Carvana over the recent three months.

Insights into Volume & Open Interest

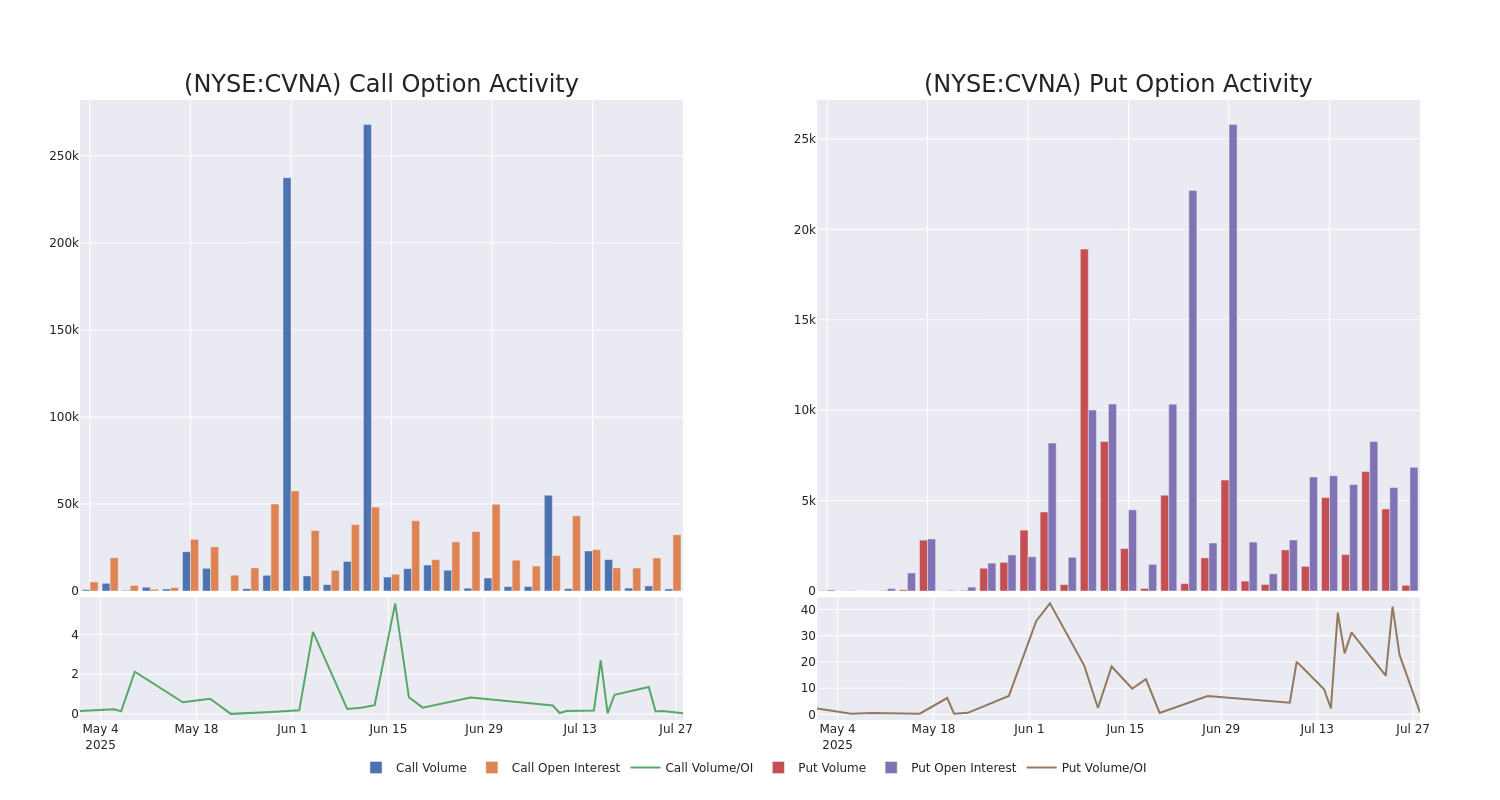

In terms of liquidity and interest, the mean open interest for Carvana options trades today is 4352.78 with a total volume of 1,533.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carvana's big money trades within a strike price range of $300.0 to $430.0 over the last 30 days.

Carvana Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | TRADE | BEARISH | 08/08/25 | $48.4 | $46.5 | $46.5 | $300.00 | $4.6M | 9.0K | 5 |

| CVNA | PUT | TRADE | NEUTRAL | 08/08/25 | $24.45 | $22.25 | $23.38 | $335.00 | $2.3M | 5.0K | 0 |

| CVNA | CALL | SWEEP | BEARISH | 09/19/25 | $6.45 | $5.45 | $5.77 | $430.00 | $578.4K | 2.0K | 1.0K |

| CVNA | PUT | SWEEP | BEARISH | 08/01/25 | $20.0 | $19.6 | $20.0 | $330.00 | $400.0K | 1.0K | 180 |

| CVNA | PUT | SWEEP | NEUTRAL | 08/01/25 | $31.2 | $29.5 | $30.35 | $350.00 | $242.0K | 508 | 0 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

In light of the recent options history for Carvana, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Carvana

- With a trading volume of 224,280, the price of CVNA is up by 0.64%, reaching $334.23.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 2 days from now.

Professional Analyst Ratings for Carvana

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $404.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Gordon Haskett lowers its rating to Hold with a new price target of $329.

* An analyst from Oppenheimer upgraded its action to Outperform with a price target of $450.

* An analyst from Wells Fargo persists with their Overweight rating on Carvana, maintaining a target price of $390.

* Consistent in their evaluation, an analyst from JMP Securities keeps a Market Outperform rating on Carvana with a target price of $440.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Carvana with a target price of $415.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Carvana with Benzinga Pro for real-time alerts.