The Technician's Playbook: Exxon Mobil Revisits Long-Term Support Level

Disappointment with the pace of the global oil market recovery once again has Exxon Mobil Corporation (NYSE: XOM) shares trading near the critical $80 support level. A breakdown below $80 support could be bad news for Exxon bulls. Here's why.

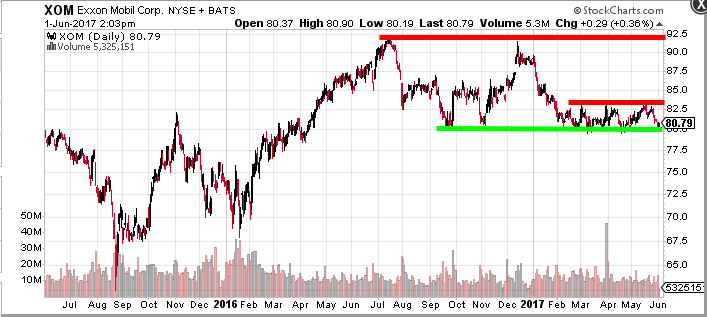

The $80 level has served as support for Exxon since mid-2016. The stock dipped as low as $80.07 in September and bounced again off of $80.53 again in November. After rebounding as high as $91.51 in December following the OPEC crude oil production cut agreement, the stock drifted lower in January and has been hugging $80 for more than four months now.

Related Link: OPEC Cuts Aren't Cutting It

The green $80 support level and two red resistance levels at $83 and $92 are included in the chart below.

So far, the $80 support level has held, leaving the stock trapped in a tight range between support at $80 and resistance at around $83. A breakdown below this range would eliminate critical support and could send Exxon shares tumbling back to the $70 level that served as support in early 2016.

If Exxon follows the same trading pattern it has demonstrated since February, the stock could once again bounce off of $80 and head back toward $83 in the weeks ahead. A breakout above $83 could be a sign the wider trading range between $80 and $92 is back in play.

One thing is certain — Exxon has severely lagged the market so far in 2017. While the S&P 500 is up more than 8 percent year to date, Exxon is down 10.7 percent on the year.

Joel Elconin contributed to this report.

Related Link: The Paris Climate Agreement's Most Surprising Defender: Exxon Mobil

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: crude Crude Oil OilTechnicals Commodities Top Stories Markets Trading Ideas Best of Benzinga