FuelCell Energy (FCEL) Stock Plummets 9% Amidst Renewable Energy Policy Fears: What's Going On?

FuelCell Energy Inc (NASDAQ:FCEL) stock is trading sharply lower during Tuesday’s session amidst a broader sell-off in the renewable energy sector. Here’s what investors need to know.

What To Know: The downturn follows the U.S. Senate Finance Committee’s unveiling of its tax bill, which proposes a drastic reduction in renewable energy incentives.

Specifically, the Senate’s draft bill outlines a complete phase-out of tax credits for solar and wind energy by 2028, accelerating the rollback of incentives initially established under the Inflation Reduction Act of 2022.

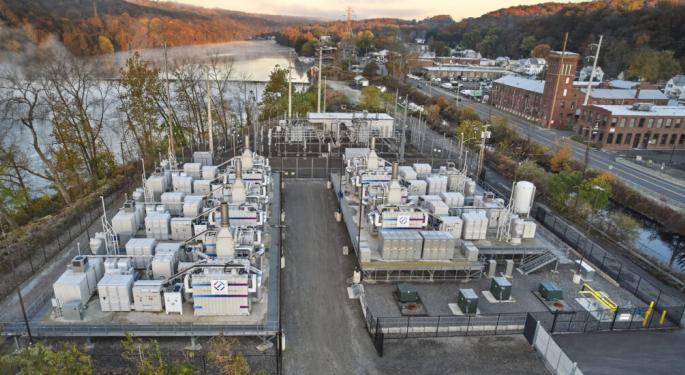

While FuelCell Energy primarily focuses on fuel cell technology, which generates clean energy from natural gas, biogas or hydrogen, its inclusion within the broader electrical equipment industry and the general market’s negative reaction to reduced renewable energy support likely impacted investor sentiment.

Read Also: What’s Going On With Plug Power Stock?

The bill’s proposal to eliminate residential solar tax credits and consumer incentives for energy efficiency upgrades further tightens the landscape for renewable energy investments, indirectly affecting companies like FuelCell Energy by signaling a potential decrease in overall clean energy infrastructure development and demand for alternative energy solutions.

In contrast, nuclear energy stocks saw gains due to extended tax incentives in the same bill, highlighting a shift in federal support. The uncertain political outlook for the bill’s passage continues to weigh on the sector.

Price Action: According to data from Benzinga Pro, FuelCell Energy is currently trading at $6.30, down 9.27% midday Tuesday. Session volume stands at 1.101 million shares, slightly below its 100-day average of 1.177 million shares.

Read Also: No Rate Cuts Yet, Fed Wants To See Where Tariffs Land: Here’s What To Watch Wednesday

How To Buy FCEL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in FuelCell Energy’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

According to data from Benzinga Pro, FCEL has a 52-week high of $24.90 and a 52-week low of $3.58.

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: why it's movingNews