JPMorgan, Bank Of America, And Other Banking Titans Discussing Joint Stablecoin To Tackle Crypto Competition: Report

Top U.S. banks are contemplating a joint venture to issue a dollar-pegged stablecoin in an attempt to counter the increasing competition from the cryptocurrency sector, according to a report dated Thursday.

What Happened: Companies co-owned by JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC) are exploring the possibility of a joint stablecoin, the Wall Street Journal reported, citing sources familiar with the matter. The discussions, still in their infancy, involve Early Warning Services, the operator of mobile payment app Zelle, and the Clearing House, a real-time payment network.

The decision to proceed with the stablecoin will hinge on several factors, including legislative actions around stablecoins and the demand for them. The banking industry has been gearing up for the potential widespread adoption of stablecoins, which could divert the deposits and transactions they handle.

A Bank of America spokesperson declined to comment when contacted by Benzinga. Responses from other banks are awaited.

Why It Matters: The potential joint venture by these banking giants comes at a time when the Senate is making strides towards the final passage of the GENIUS Act, also known as the stablecoin bill. The proposed legislation aims to establish the first U.S. regulatory framework for issuers of stablecoins—digital tokens that are tied to fiat currencies like the dollar.

The SEC has already clarified that certain stablecoins, particularly those pegged to the U.S. dollar and backed by low-risk, liquid assets, are not securities.

Price Action: Financial Select Sector SPDR Fund (NYSE:XLF), an exchange-traded fund that exposes investors to the major U.S. money banks. closed 0.12% lower at $50.23 during Thursday’s trading session, according to data from Benzinga Pro.

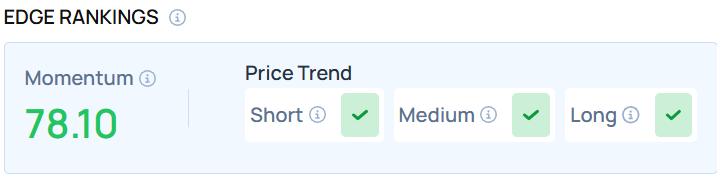

The stock exhibited a moderately high momentum score as of this writing. To access more such high-momentum banking ETF stocks, visit Benzinga Edge Stock Rankings for more details.

Photo Courtesy: Panchenko Vladimir on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: banks Senate stablecoin billCryptocurrency News Markets Movers Trading Ideas