Top 3 Energy Stocks Which Could Rescue Your Portfolio For July

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Antero Resources Corp (NYSE:AR)

- Antero Resources will issue its second quarter earnings release on Wednesday, July 30, after the close of trading on the New York Stock Exchange. The company's stock fell around 7% over the past five days and has a 52-week low of $24.53.

- RSI Value: 28.4

- AR Price Action: Shares of Antero Resources fell 2.9% to close at $35.56 on Wednesday.

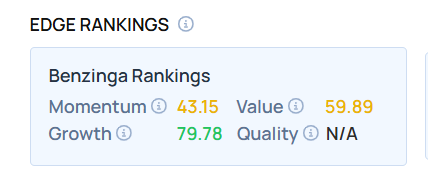

- Edge Stock Ratings: 43.15 Momentum score with Value at 59.89.

Expand Energy Corp (NASDAQ:EXE)

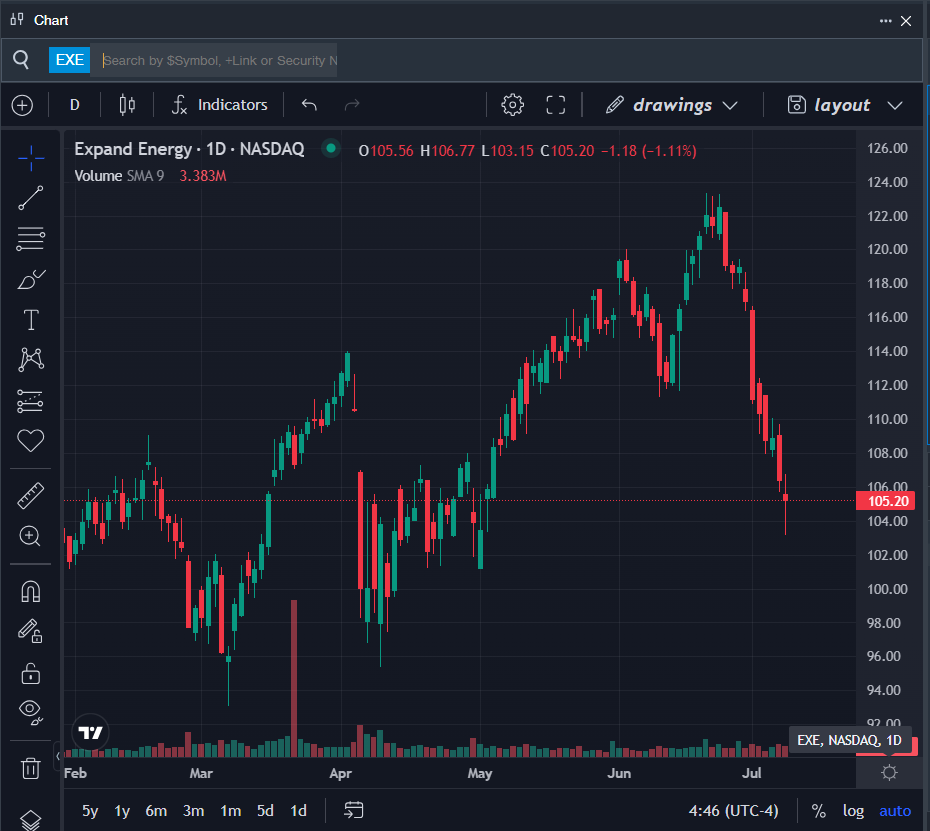

- On July 1, Mizuho analyst Nitin Kumar maintained Expand Energy with an Outperform rating and raised the price target from $141 to $142, while UBS analyst Josh Silverstein maintained the stock with a Buy and raised the price target from $144 to $145. The company's stock fell around 6% over the past five days and has a 52-week low of $69.12.

- RSI Value: 27.8

- EXE Price Action: Shares of Expand Energy fell 1.1% to close at $105.20 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in EXE stock.

XCF Global Inc (NASDAQ:SAFX)

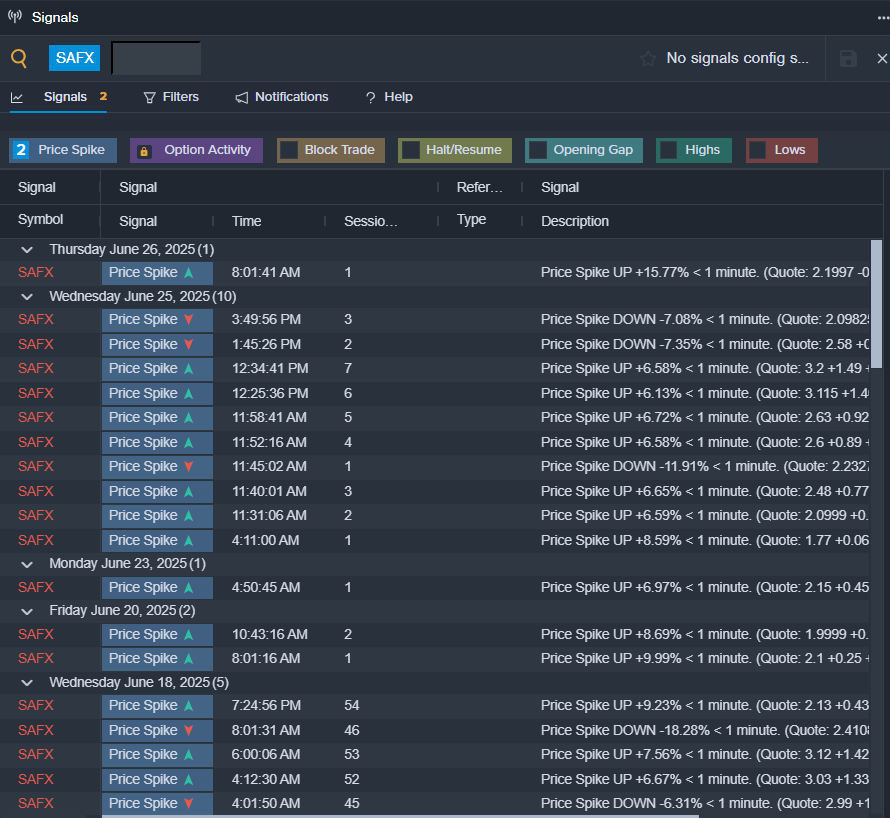

- On July 8, XCF Global said it produced over 2.5 million gallons of SAF, renewable diesel, and naphtha at New Rise Reno Facility during ramp-up phase. “This update is simple but important: New Rise is producing renewable fuels” said Mihir Dange, Chief Executive Officer and Board Chair of XCF. “We’ve already produced over 2.5 million gallons of SAF, renewable diesel, and renewable naphtha, proving that our model works. Further, this is a testament to the dedication and expertise of our team, who are focused on executing our strategy and driving the clean fuel transition.” The company's stock fell around 94% over the past month and has a 52-week low of $1.42.

- RSI Value: 2.3

- SAFX Ltd Price Action: Shares of XCF Global fell 6.8% to close at $1.50 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SAFX shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: energy stocks Expert Ideas Pro ProjectLong Ideas News Pre-Market Outlook Markets Trading Ideas